Things have changed amid the coronavirus pandemic. Previously, landlords held the advantage, but with high unemployment and furlough rates, the renter pool has dwindled, leaving landlords more vulnerable and causing them to slash prices.

According to a new report from realtor.com® report, 36 of the largest 100 counties are seeing rent price declines compared to last year.

Here’s what’s happening:

-In the 100 largest counties, the median rent for studio units was $1,347, down 0.5 percent year-over-year. One-bedroom units are at $1,502, up 1.0 percent year-over-year. Two-bedroom units are $1,873, up 2.3 percent year-over-year.

-In September, one-bedroom rents declined year-over-year in 36 of the 100 largest counties, up from just six metros in March. Two-bedroom rents declined year-over-year in 25 of the 100 largest counties, up from just 12 in March.

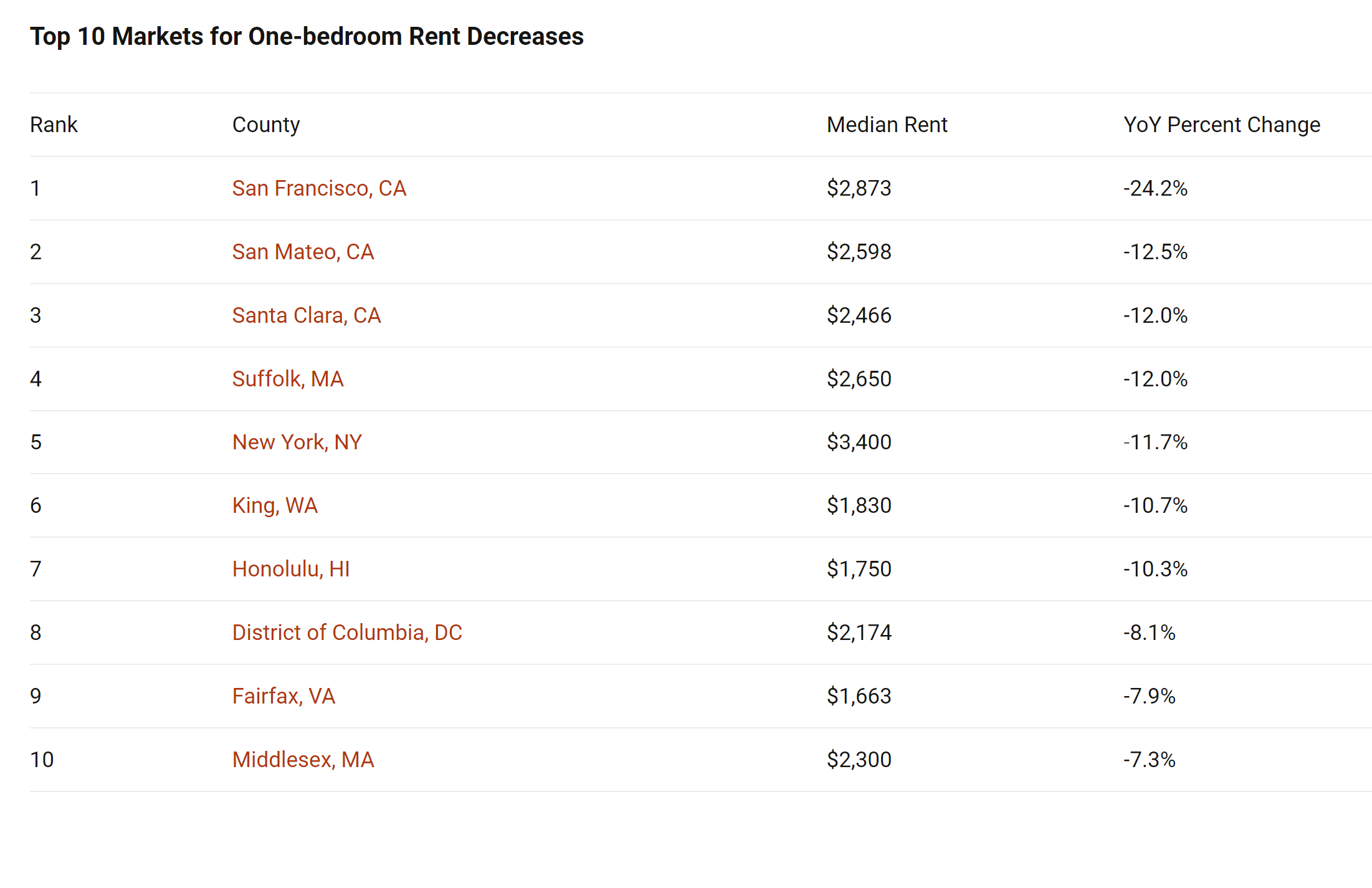

-High-tech hubs and expensive markets in the bay area, such as San Francisco, San Mateo and Santa Clara counties, have experienced the largest declines in rents across the board, along with Manhattan, Boston, Seattle and Washington, D.C.

-Fast-growing cities (e.g., Rochester, N.Y., and Colorado Springs, Colo.) and spillover markets (e.g., Tacoma, Wash.) are seeing the largest increases in rents compared to last year.

These are the top 10 markets for one-bedroom rent decreases, according to the report:

“Renters now have the upper-hand over landlords in many of the nation’s most expensive cities. As vacant apartments begin to stack up, many landlords are scrambling to lower rents and offer discounts in an effort to entice or keep a shrinking pool of renters,” said Danielle Hale, realtor.com’s chief economist. “Many renters are likely heading to more affordable areas where they can get more space at a cheaper price, while others are moving home and viewing this as an opportunity to save for a downpayment. Interestingly, this is pushing up rents in secondary markets and may make home buying in these markets even more attractive. Looking forward, the future of rents in many of these cities will depend on whether companies require employees to work from the office or continue to allow remote work.”

To view the entire report, click here.