CoreLogic® recently released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2020. Nationally, home prices increased 7.3 percent in October 2020, compared with October 2019, marking the fastest annual appreciation since April 2014. On a month-over-month basis, home prices increased by 1.1 percent compared to September 2020.

Home prices climbed in recent months due to heightened demand and ongoing home supply constraints. The supply shortage could further intensify as COVID-19 cases continue to rise and would-be sellers remain hesitant about putting their homes on the market. However, to keep up with the rising demand, new home construction surged in October and builder confidence reached a new high for the third consecutive month.

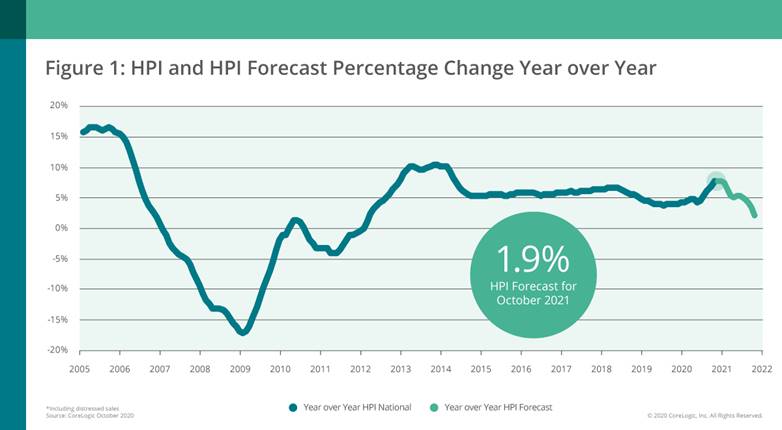

The decreased pressure on supply could moderate home price growth over the next year. This is reflected in the CoreLogic HPI Forecast, which shows home prices slowing to 1.9 percent by October 2021. However, should the economic recovery from the pandemic be more robust, then we would expect projections for home price performance to improve.

“Homebuyers have been spurred by record-low mortgage rates and an urgency to buy or upgrade to more space, especially as much of the American workforce continues to work from home,” said Frank Martell, president and CEO of CoreLogic. “First-time buyers in particular should remain a big part of next year’s home purchases, as the largest wave of millennials is heading into prime home-buying years.”

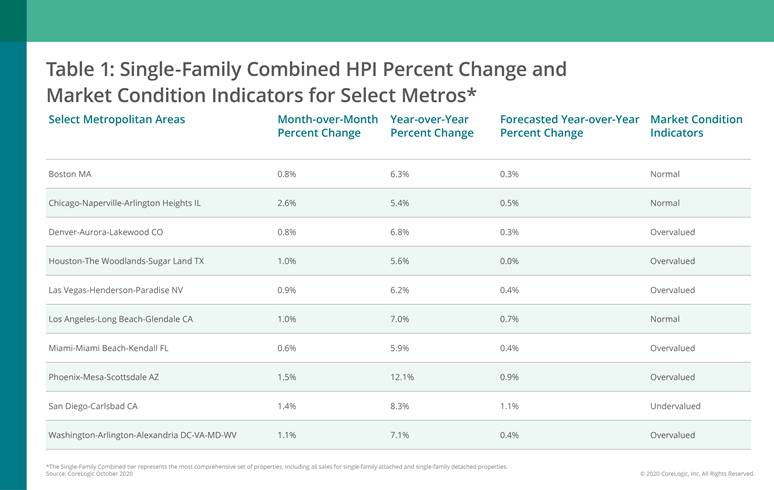

Despite the rapid acceleration of national home price growth, local markets continue to vary. For instance, in Phoenix, where there is a severe shortage of for-sale homes, prices increased 12.1 percent in October. Meanwhile, the New York-Jersey City-White Plains metro recorded only a small annual increase of 2.1 percent, as residents continue to seek out more space in less densely populated areas. At the state level, Maine, Idaho and Arizona experienced the strongest price growth in October, up 14.9 percent, 13.1 percent and 12 percent, respectively.

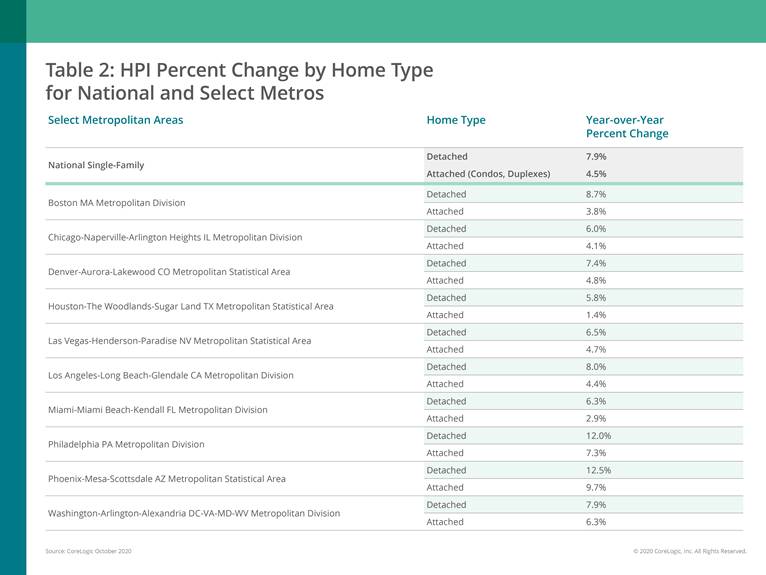

“The pandemic has shifted homebuyer interest toward detached rather than attached homes,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Detached homes offer more living space and are typically located in less densely populated neighborhoods. And while prices of single-family detached homes posted an annual increase of 7.9 percent in October, the price of attached homes rose only 4.5 percent year-over-year.”

The HPI Forecast also reveals the disparity in expected home price growth across metros. In markets like Las Vegas, where the local tourism economy and job market continue to struggle, home prices are expected to decline 1.8 percent by October 2021. Conversely, in San Diego, home prices are forecasted to increase 7.9 percent over the next 12 months as low inventory continues to push prices up.

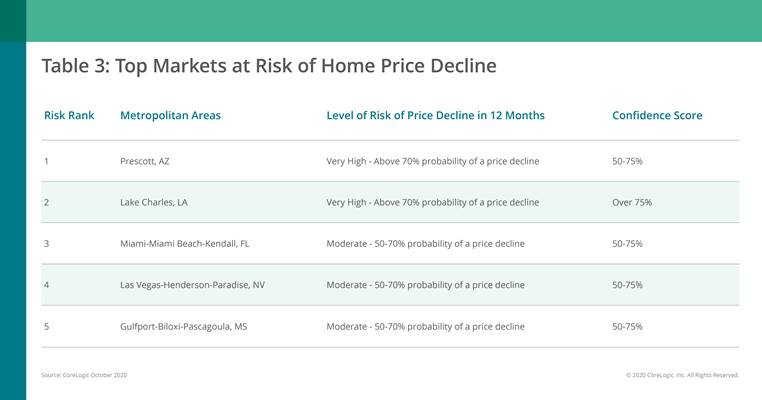

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that metros such as Lake Charles, Louisiana, and Prescott, Ariz., are at the greatest risk (above 70 percent) of a decline in home prices over the next 12 months, while Miami, Las Vegas and Gulfport-Biloxi-Pascagoula, Miss., are at moderate risk (50 percent – 70 percent) of a decrease.

For more information, please visit www.corelogic.com.