While their collective sales volume was a staggering $2.4 trillion-plus in 2021, the Top 1,000 brokers ranked in RISMedia’s 2022 Power Broker Report are facing a very different landscape as this year progresses.

According to the results of RISMedia’s annual Power Broker Survey, total sales volume for the top 1,000 firms in 2021 increased by nearly $800B YoY, with the average transaction amount soaring from $394,043 in 2020 to $492,857 in 2021. With not enough supply to meet demand, home-sale prices—and brokerage sales volume—rose to new heights.

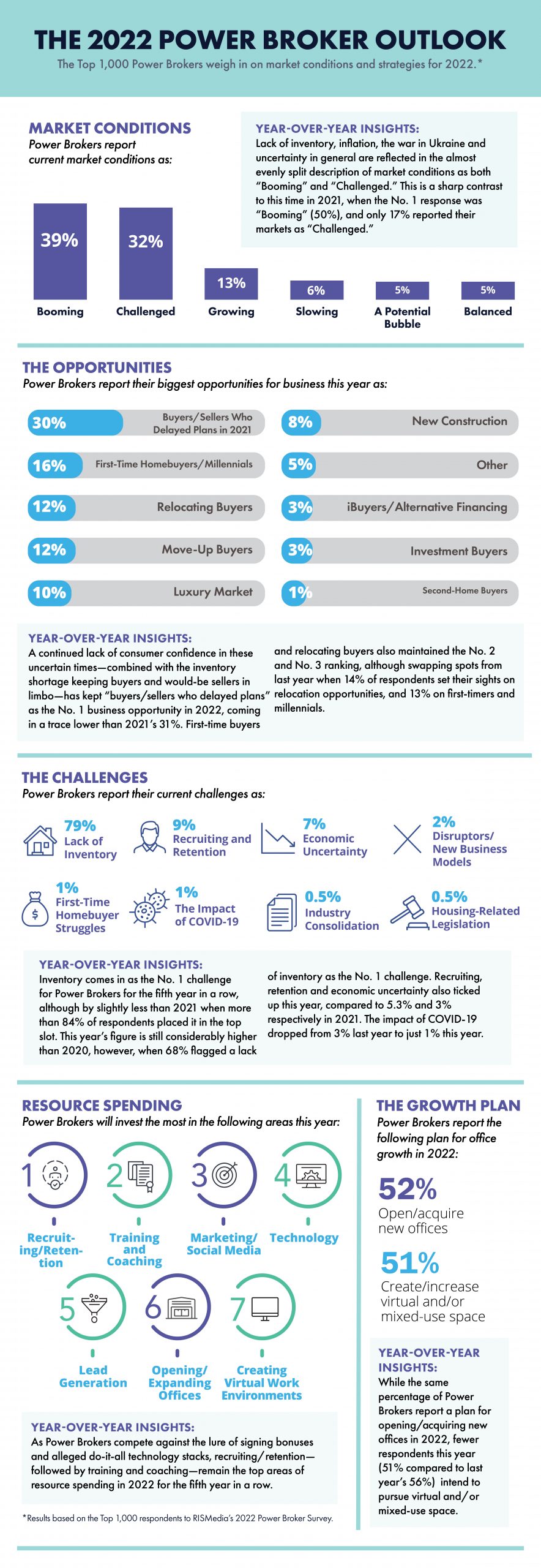

The Power Broker Survey also polled brokers on their market sentiments, challenges, opportunities and investment strategies for the year ahead. For the fifth year in a row, respondents flagged a lack of inventory as their top challenge, chosen by 79% of Power Brokers in this year’s report—less than the 84% in 2021, but notably higher than 2020’s 68%.

For some brokers, however, the competitive atmosphere of last year’s housing market will help drive sales in 2022. “Buyers continue to be frustrated by the lack of inventory and difficulty in securing a contract,” explains Jean Rawls, principal at Keller Williams Realty – The Rawls Group in Georgia. “Their inability to get under contract in 2021 will continue to drive sales in 2022.”

The persistent strain on inventory is part of the reason why less than half of this year’s Top 1,000 described their current market conditions as “booming” compared to 50% who described them as such in 2021. More tellingly, the number of brokers who described their market as “challenged” rose from 17% in 2021 to 32% in 2022.

With nagging concerns about inflation, interest rates, affordability, inventory and geopolitical unrest, Power Brokers are unsure about what lies ahead for the remainder of the year. They have, however, reckoned with the fact that there will not be a repeat of last year’s historic production levels.

“Low inventory, rising interest rates and consumer uncertainty will apply a drag on 2022, resulting in 10%-plus lower sales numbers than 2021,” says Joe Miller, broker/owner of Old Colony, REALTORSⓇ in West Virginia.

“Our market is contending with the effects of a short supply of homes for sale, building materials and labor while interest rates are on the rise,” reports Tyler Lein, general manager of Arizona’s RE/MAX Excalibur. “Our home prices continue to climb, and eventually, we will be viewed as ‘too expensive’ to companies planning to move operations to our state. This is something that has caused the boom, but will also cause a correction.”

Unfavorable market trends are creating problems for those just starting out. “The challenge around the lack of inventory and increasing interest rates has housing market prices outgrowing the first-time buyers,” says Sarah Zdeb, broker/owner of JPAR Carolina Living in North Carolina.

Find more results from RISMedia’s exclusive Power Broker Report research in the graphic below. We’ll be tracking broker confidence and monitoring concerns monthly in RISMedia’s Broker Confidence Index (BCI).

Maria Patterson is RISMedia’s executive editor. Email her your real estate news ideas, maria@rismedia.com.

Maria Patterson is RISMedia’s executive editor. Email her your real estate news ideas, maria@rismedia.com.