Ask the 60-some percent of brokers in RISMedia’s 2017 Power Broker Survey: Almost every housing market is plagued by short supply. In fact, inventory nationally for pre-owned properties is at 3.9 months, down 10.4 percent from last year, the National Association of REALTORS® (NAR) recently reported.

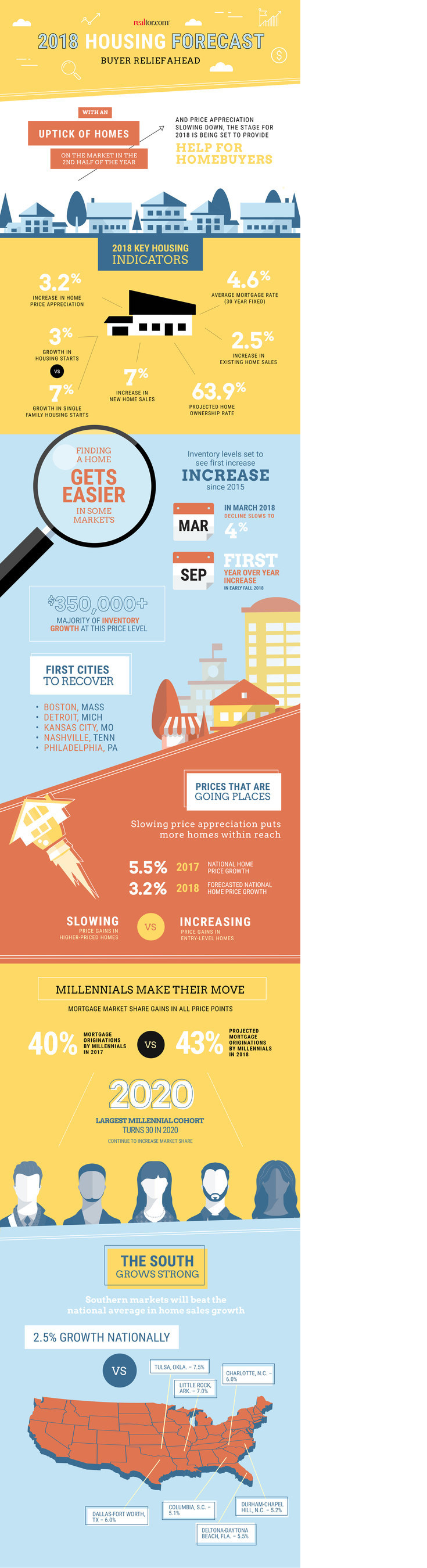

The challenge, according to realtor.com®, could moderate in the next year. Groundbreaking is projected to ramp up 3 percent, with single-family starts up 7 percent, realtor.com’s 2018 National Housing Forecast reveals.

The catch? Activity won’t kick up until later in the year, and many builds will be higher- and/or mid-priced—not an ideal scenario in the short term. Lower-priced homes, which were hit hardest in the recession, will be the last to recover.

“We are forecasting next year to set the stage for a significant inflection point in the housing shortage,” says Javier Vivas, director of Economic Research for realtor.com. “Inventory increases will be felt in higher-priced segments after home-buying season [in the fall], which limits their impact on total sales of the year.”

Home prices will increase in 2018, but at a lesser pace than in 2017, the forecast shows: 3.2 percent. As with inventory, prices in the starter supply will take longer to lose steam. Existing-home sales are expected to grow 2.5 percent to 5.60 million. Considerable gains in prices and sales will be seen in: Las Vegas-Henderson-Paradise, Nev.; Dallas-Ft. Worth-Arlington, Texas; Deltona-Daytona Beach-Ormond Beach, Fla.; Stockton-Lodi, Calif.; Lakeland-Winter Haven, Calif.; Salt Lake City, Utah; Charlotte-Concord-Gastonia, N.C.; Colorado Springs, Colo.; Nashville-Davidson-Murfreesboro-Franklin, Tenn.; and Tulsa, Okla.

Realtor.com also anticipates 43 percent of buyers in 2018 will be millennials, up from the 40 percent projected for 2017. The biggest group of millennials is turning 30 in 2020, so their share is likely to continue tracking upward.

Expected to grow, as well, are mortgage rates, averaging 4.6 percent and possibly reaching 5 percent by year-end, the forecast states. Action by the Federal Reserve and economic factors, including inflation, will precede the rise. Markedly, more first-time homebuyers were able to get a Federal Housing Administration (FHA) mortgage this year than last year, despite a rate uptick. The 30-year, fixed mortgage rate averages 3.92 percent at present, according to Freddie Mac.

2018’s homeownership rate, meanwhile—which has gone up thus far this year—is forecasted to land at 63.9 percent.

A potential wrench is tax reform. The forecast was made prior to the House bill passing and the Senate bill being voted on; as such, realtor.com cautions that certain cuts—among others, the mortgage interest deduction and the state and local tax (SALT) deduction—could lead to less in the way of prices and sales.

The forecast, however, is optimistic overall.

“As we head into 2019 and beyond, we expect to see these inventory increases take hold and provide relief for first-time homebuyers and drive sales growth,” Vivas says.

For more information, please visit www.realtor.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

For the latest real estate news and trends, bookmark RISMedia.com.