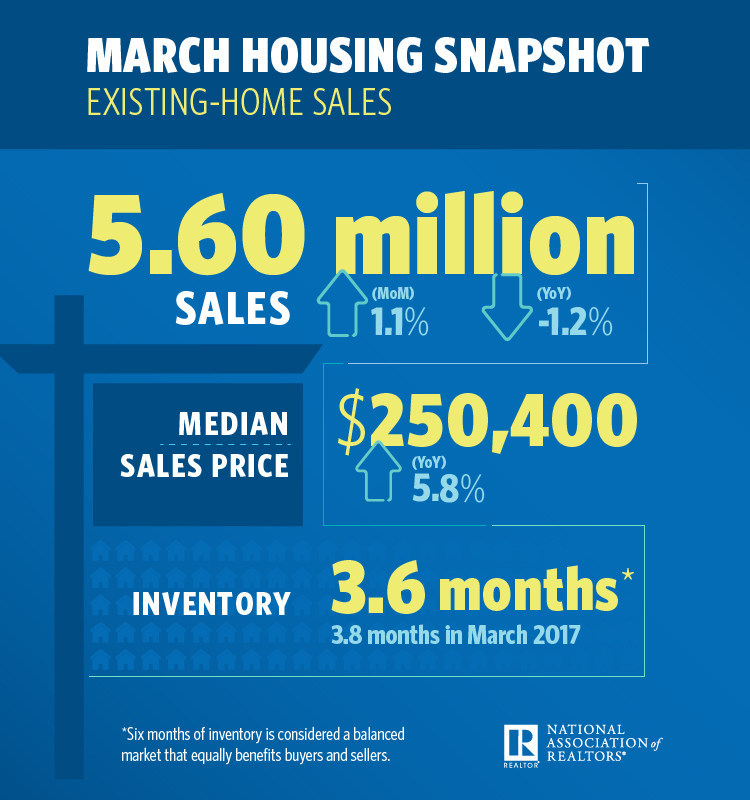

Building on February’s gains—and for the second time this year—existing-home sales have strengthened, the National Association of REALTORS® (NAR) reports. March sales increased 1.1 percent to 5.6 million, but they were down 1.2 percent from the prior year. Inventory increased, as well: 5.7 percent to 1.67 million, but 7.2 percent lower than the prior year.

“Robust gains last month in the Northeast and Midwest—a reversal from the weather-impacted declines seen in February—helped overall sales activity rise to its strongest pace since last November at 5.72 million,” says Lawrence Yun, chief economist at NAR. “The unwelcoming news is that while the healthy economy is generating sustained interest in buying a home this spring, sales are lagging year-ago levels because supply is woefully low and home prices keep climbing above what some would-be buyers can afford.”

Currently, inventory is at a 3.6-month supply. Existing homes averaged a brisk 30 days on market in March, four days less than the prior year. All told, 50 percent of homes sold were on the market for less than one month.

“REALTORS® throughout the country are seeing the seasonal ramp-up in buyer demand this spring, but without the commensurate increase in new listings coming onto the market,” Yun says. “As a result, competition is swift and homes are going under contract in roughly a month, which is four days faster than last year and a remarkable 17 days faster than March 2016.”

The metropolitan areas with the fewest days on market and most realtor.com® views in March, according to realtor.com’s Market Hotness Index, were San Francisco-Oakland-Hayward, Calif.; Vallejo-Fairfield, Calif.; Colorado Springs, Colo.; Midland, Texas; and San Jose-Sunnyvale-Santa Clara, Calif.

The median existing-home price for all house types (single-family, condo, co-op and townhome) was $250,400, a 5.8 percent increase from the prior year. The median price of an existing single-family home was $252,100, while the median price for an existing condo was $236,100.

Existing-home sales in the single-family space came in at 4.99 million in March, a 0.6 percent increase from 4.96 million in February, but a 1 percent decrease from 5.04 million the prior year. Existing-condo and -co-op sales came in at 610,000, a 5.2 percent increase from February, but a 3.2 percent decrease from the prior year.

Twenty percent of existing-home sales in March were all-cash, with 15 percent by individual investors. Four percent were distressed.

Two of the country’s major regions had higher sales, rising 5.7 percent to 1.29 million in the Midwest, with a median price of $192,200, and 6.3 percent to 680,000 in the Northeast, with a median price of $270,600. The South and West had reduced sales, falling 0.4 percent to 2.4 million in the South, with a median price of $222,400, and 3.1 percent to 1.23 million in the West, with a median price of $377,100.

“Although the strong job market and recent tax cuts are boosting the incomes of many households, speedy price growth is squeezing overall affordability in several markets, especially those out West,” says Yun.

First-time homebuyers comprised 30 percent of existing-home sales in March, up from 29 percent February.

“First-time buyers continue to make up an underperforming share of the market because there are simply not enough homes for sale in their price range,” says NAR President Elizabeth Mendenhall. “Supply conditions improve in higher-up price brackets, which means those trading up should see considerable interest in their home, as well as more listings to choose from during their own search.”

According to Keller Williams Chief Economist Ruben Gonzalez, existing-home sales are on a familiar track.

“We continue to forecast that existing-home sales in 2018 will be at or slightly below 2017 sales,” says Gonzalez. “If inventory conditions remain restrictive, we also expect to continue to see home price appreciation accelerate. Based on data and anecdotal evidence, the most restrictive inventory conditions currently exist for entry-level housing, and this is also where we anticipate the most acceleration in home price appreciation.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.