Between college debt, rent and stagnant wages, budgeting for a home is a lofty task—and when it comes to the down payment, millennials are less likely to meet the recommended standard, according to research by Zillow.

Forty-three percent of homebuyers overall had 20 percent or more saved, according to Zillow’s 2018 Consumer Housing Trends Report—but, many millennials were short of the threshold. Why?

Aside from budget constraints that are inhibiting savings, first-time homebuyers lack the proceeds from a sale; in fact, to accumulate enough for a down payment, 51 percent of millennials were gifted funds or loaned money from relatives, the report shows.

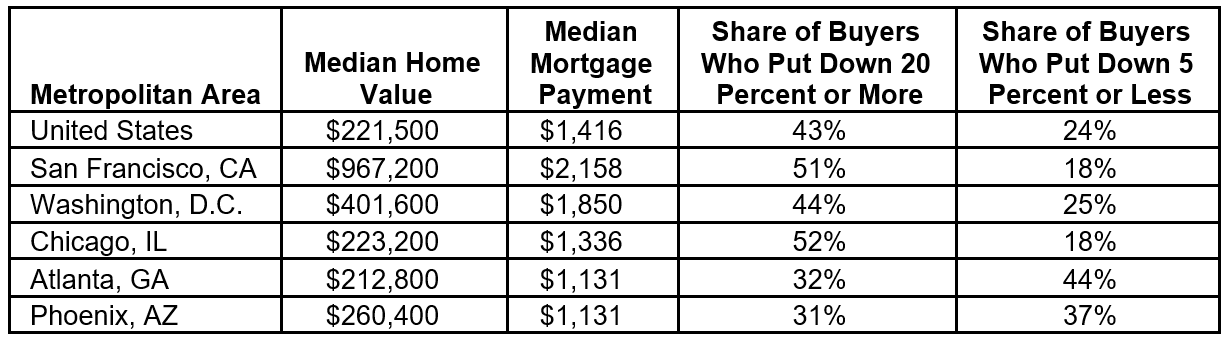

Comparing Atlanta, Chicago, Phoenix, San Francisco and Washington, D.C., 52 percent of Chicago homebuyers had 20 percent or more saved—the highest of the five markets, according to the report.

The ability to amass 20 percent depends on earnings and the market, among other factors. In Chicago, for example, the annual average income for millennials is $50,500, and an entry-level home is $177,300, typically, a RealEstate.com report shows. To attain 20 percent, a buyer in Chicago would need to save for three years and three months—a contrast to homebuyers in San Francisco, where the savings timeline is a whopping 18 years, according to Zillow’s Consumer Housing Trends Report.

Convention has held at 20 percent, and with good reason. Without it, borrowers not only have higher monthly payments, but the added expense of insurance, and (generally) a higher interest rate.

With affordability a concern, however, how feasible—or necessary—is it today? There is assistance available to first-time homebuyers in the majority of states, as well as at the federal level, and there are lenders with low- or no-down payment offerings.

“There are many mortgage options that require less than 20 percent down, but buyers should be careful that they don’t set themselves up to be underwater,” says Aaron Terrazas, senior economist at Zillow. “Interest rates are rising, of course, but for many, waiting a bit longer and saving for a larger down payment might still be the way to go as they weigh their current stability and housing needs against their long-term futures.”

Your best bet? Consult your lender or REALTOR®—and start saving today.

“Saving up for a down payment can be tough and requires good budgeting and long-term planning, especially when for many of us the cost of rent and everyday life outpaces what we’re able to put in the bank,” Terrazas says. “Even if you don’t have plans to buy a home in the next year or two, it never hurts to start setting aside savings for a future home purchase.”

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.