For many in the rental market, a lack of affordability related to increasing rents continues to be a significant concern, and it’s impacting not only lower-income earners, but the middle class as well. A recently released report from the Harvard University Joint Center for Housing Studies, “America’s Rental Housing 2020,” found there are several factors impacting the markets: increased rents, insufficient regulations, increased demand from high-income renters and even climate change.

Rising Rents Pose Challenge

Which segments are struggling the most? According to the report, U.S. residents earning median incomes—those between $30,000 and $75,000—are having trouble paying their rent. This segment of the population is now cost-burdened, paying more than 30 percent of what they earn toward housing expenses. Impacted even more severely, renters in the lowest income brackets are spending over half of their monthly income on housing.

“Despite the strong economy, the number and share of renters burdened by housing costs rose last year after a couple of years of modest improvement,” said Chris Herbert, managing director of the Joint Center for Housing Studies, in a statement. “And while the poorest households are most likely to face this challenge, renters earning decent incomes have driven this recent deterioration in affordability.”

What do the markets look like? According to the report, between 2012 and 2017, the number of units that rent for over $1,000 (or more) drastically increased by 5 million. Meanwhile, units renting for under $600 dropped by 3.1 million.

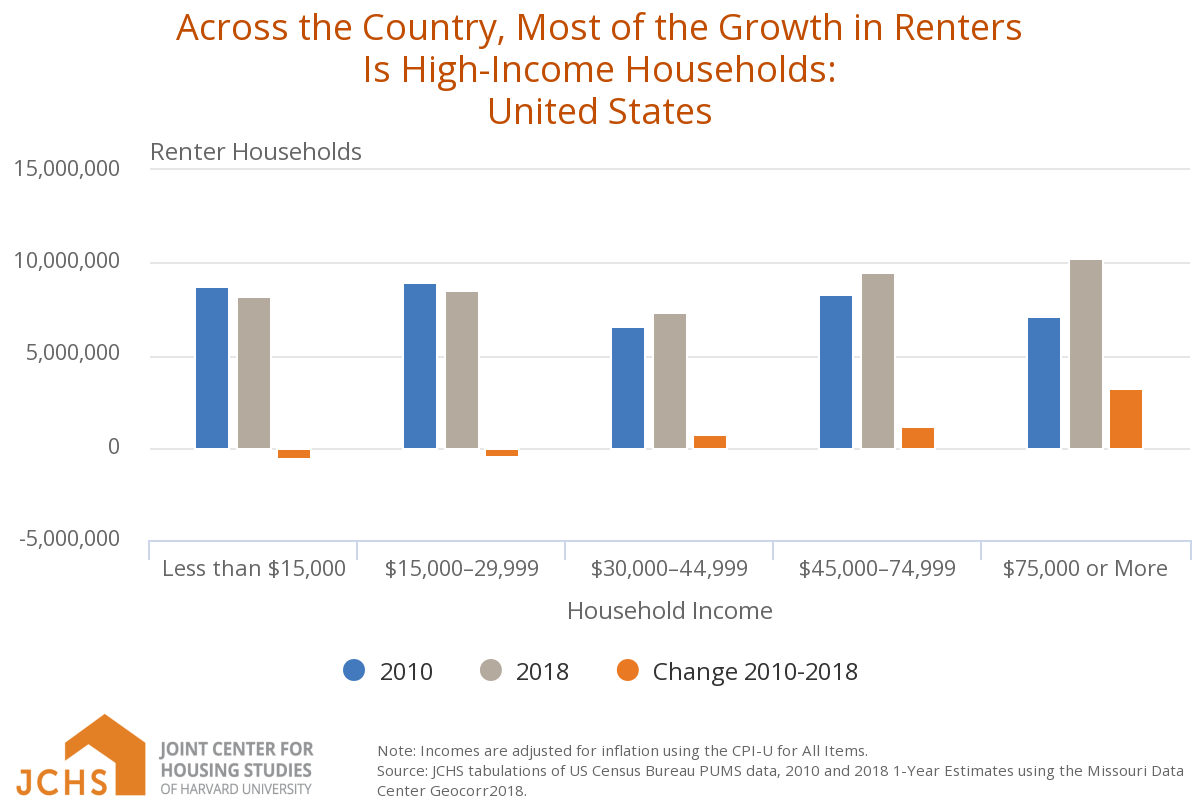

Low-income renters are struggling, with some left homeless and many put at risk for eviction. Between 2010 and 2018, renters earning below $30,000 annually fell by almost 1 million. Homelessness increased between 2016 and 2018 to 552,830—a problem especially in high-cost states such as California, Oregon and Washington, shows the report.

Who, then, are the markets catering to?

“Young, college-educated households with high incomes are really driving current rental demand,” said Whitney Airgood-Obrycki, a research associate at the Center and lead author of the report.

Increased Demand From High-Income Renters

High-income earners are transforming the rental markets. From 2016-2018, these renters increased by 545,000, and those making at least $75,000 made up over three-quarters of the overall renter growth between 2010-2018.

This is reshaping new construction, with most units catered to the high-end crowd. According to the report, new multifamily construction in 2019 was set to either match or exceed 2018 numbers, during which starts increased 6 percent to 374,100 units. Much of these, however, were only available to those earning at the higher tiers.

The median ask for unfurnished units completed between July 2018 and June 2018 was $1,620—a cost that typically accounts for amenities such as air conditioning and in-unit laundry. Under the thousand mark? That’s hard to find—only 12 percent of units were available in that price range during this time period. A bulk of new-construction units (about one in five) were on the market for at least $2,450.

The lack of new construction in lower-priced tiers, along with rising demands for luxury units, is causing a shrinking supply of low-cost rentals. Between 2012 and 2017, the number of units with rents below the $600 mark fell drastically by 3.1 million, bringing the national rental stock to 25 percent in 2017, down from 33 percent in 2012.

Regulation Hopes to Ease Rental Burden

In order to reverse the trend and ease the burden on low-income earners, several state and local governments have moved to lessen restrictions on land-use regulations, hoping to encourage the production of lower-cost homes.

Many have enacted plans to increase affordable supply and funding that can go toward reforming zoning that would allow higher-density construction. In Minneapolis and Oregon, for example, recently enacted reforms will lead to new multi-unit construction in areas that were previously zoned for single-family properties, according to the report.

“Last year, Minneapolis became the first large American city to end single-family zoning,” said Herbert. “This has the potential to greatly expand the rental supply and improve affordability in the city, but, ultimately, only the federal government has the scope and resources to provide housing assistance at a scale appropriate to need across the country.”

To address the increasing problem of homelessness and eviction for low-income earners, local governments have implemented programs to lower the costs of social services that support the homeless, as well as increase renter protections.

However, limited funds are available, leaving a growing gap in the affordability crisis that even government regulation is having trouble keeping up with. Many organizations—some tied to hospitals, universities and technology companies—have taken it upon themselves to develop solutions.

Climate Change Creating Obstacles

Another factor in affordability is the rising likelihood of natural disasters that impact the renter population.

Out of the 43.7 million renter households, 10.5 million are in areas that incurred at least $1 million in damages and losses to their business and homes because of natural disasters between 2008 and 2018. These catastrophic events often leave renters vulnerable—8.1 million renter households reported not having the financial resources necessary for evacuating in case of an emergency.

A Domino Effect on Homeownership

The challenge also lies on the impact these changes are having on homeownership rates. Due to rising costs and crunched affordability, renters are having trouble saving enough to own their own home.

The report shows that for those aged 35-64, who are more traditionally likely to own a home, especially married couples with children, renting has become more common. These families are now a larger share of renter households, at 29 percent, than owner households, at 26 percent.

“Rising rents are making it increasingly difficult for households to save for a down payment and become homeowners,” said Airgood-Obrycki.

To access the report, visit www.jchs.harvard.edu.

Liz Dominguez is RISMedia’s senior editor. Email her your real estate news ideas at ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s senior editor. Email her your real estate news ideas at ldominguez@rismedia.com.

Climate Change???? What a bunch of B.S.

I find it interesting that you are commenting on the weather changing for reasons renters are having a hard time. Our weather has been changing for millions of years. Here are some notable hurricanes over the last 110 years.

https://www.nhc.noaa.gov/outreach/history/

GALVESTON 1900

ATLANTIC-GULF 1919

MIAMI 1926

SAN FELIPE-OKEECHOBEE 1928

FLORIDA KEYS LABOR DAY 1935

NEW ENGLAND 1938

GREAT ATLANTIC 1944

CAROL AND EDNA 1954

HAZEL 1954

CONNIE AND DIANE 1955

AUDREY 1957

DONNA 1960

CAMILLE 1969

AGNES 1972

TROPICAL STORM CLAUDETTE 1979

ALICIA 1983

GILBERT 1988

HUGO 1989

ANDREW 1992

TROPICAL STORM ALBERTO 1994

OPAL 1995

MITCH 1998

FLOYD 1999

KEITH 2000

TROPICAL STORM ALLISON 2001

IRIS 2001

ISABEL 2003

CHARLEY 2004

FRANCES 2004

IVAN 2004

JEANNE 2004

DENNIS 2005

KATRINA 2005

RITA 2005

WILMA 2005

IKE 2008

“Who, then, are the markets catering to? “Young, college-educated households with high incomes are really driving current rental demand,”

My tenants fit this description. It is the burden of school loan debt that is crippling their ability to leave the rental market and purchase a home. I feel that’s the burden of most of this next generation of buyers. I have a lot of parents paying off their children’s debts and/ or providing down payments. Most aren’t this fortunate.

In Toronto, a one-bedroom has gone up by 4.4% in the last 12 months. Look at the outrageous starting price, yet there is still a 4.4% increase.

I think this should be viewed from a different perspective, the burden of renting to lower income for the landlord. Why would a landlord choose to have low income units when they experience: lack of payment or late payments, destruction of property, and an attitude of entitlement? I think this problem needs to be faced two fold: support of landlord’s right of ownership and the tenant’s responsibility to uphold what is promised in the lease. My experience is that tenants have all the “rights” while landlord is expected to foot the bill.

In my opinion this is an example of backwards elitist thinking. It is great news that because of the economy, people are able to afford higher end rentals. Local governments can team up with churches and other like-minded institutions and businesses to subsidize housing for the poor. And those who are subsidized with rental vouchers, medical vouchers (like Medicaid), food vouchers, and transportation vouchers should be able to find a way to get by. Personally I think that everyone who is able bodied & on assistance should work. If you live in subsidized housing you should volunteer once a month to garden, clean, and keep the facility shipshape; or babysit children so those who are able, can volunteer. It is not the governments job to take care of people. If everyone is making money and there is money left over after paying, infrastructure, and research to benefit the population, and yes, we it is not the governments job to take care of people. If everyone is making good money and there is money left over after paying for National defense, infrastructure, research to benefit the population, then yes, our government can help Those who need a handout. More importantly, we need to train them so that they can have a hand UP. There will always be those who take advantage of others. Our country is the most generous and has the most giving heart in the world. But expecting taxpayers to pay more in taxes to support those who take care of themselves of their children is asking a lot. Luckily most people are happy to give something to help others; but that should be a personal decision & not a job of the government.

I agree, when the landlord is faced with rising costs such as insurance and property taxes, where is the incentive to provide affordable housing? Or to not raise rents to market levels? And yet, I live in an area where the jobs are mainly low wage service industry positions and those workers have a tough time finding housing they can afford, business owners have a tough time finding workers due to lack of housing, so it is a vicious cycle.

My wife and I have a rental property and it’s 90% occupied every year. We have increased the rents about 70% over the past 10 years since we purchased it and if we keep it another 2 years we’ll be almost double for rental income. Global warming is a bovine fecal matter and has NOTHING to do with rents increasing and affordability. Provide a decent, safe environment for a tenant and people will rent from you. Provide garbage and you get garbage for tenants. I don’t rent to voucher/section 8 and have not need or desire to. Most laws in my area protect the landlord when a tenant is in arrears and you’d be surprised at the number that do get evicted all the while thinking they can get away with it with the next place they rent. Lessons learned on that.

Is that because lifestyle has changed and personal needs come first rather than the rent payment on the first of the month.