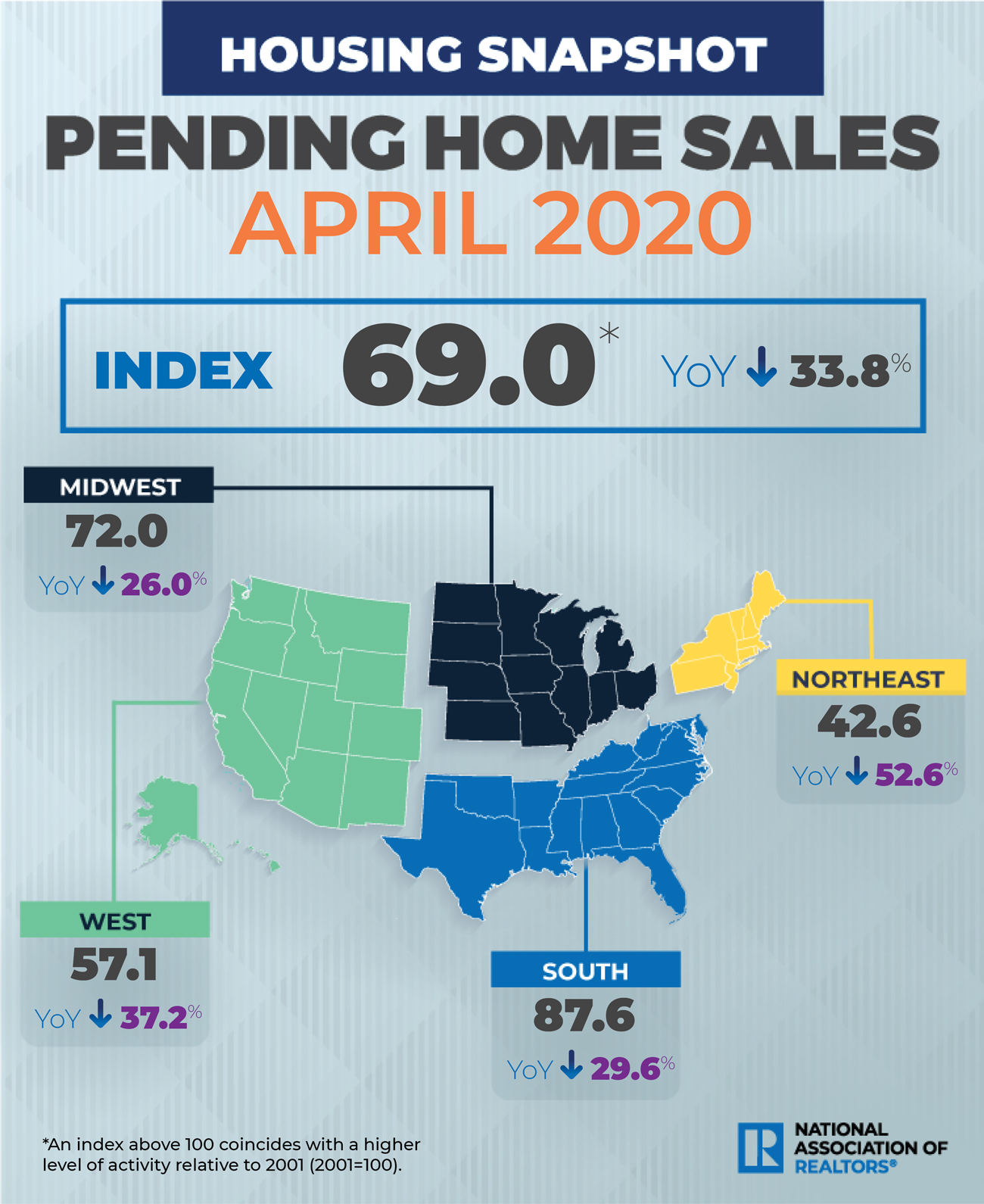

April marked two consecutive months of declines for pending home sales, according to the National Association of REALTORS’® (NAR) Pending Home Sales Index (PHSI). Every major market saw a decline, with total YoY pending home sales transactions down 33.8 percent, and decreasing 21.8 percent from March.

According to NAR, this is the largest decline in pending home sales since they began tracking these transactions in 2001. The silver lining, however? This may be the low point for pending sales, with May possibly having the lowest closed sales. Economists are hopeful the markets will begin to bounce back soon.

“With nearly all states under stay-at-home orders in April, it is no surprise to see the markedly reduced activity in signing contracts for home purchases,” said Lawrence Yun, NAR’s chief economist. “While coronavirus mitigation efforts have disrupted contract signings, the real estate industry is ‘hot’ in affordable price points with the wide prevalence of bidding wars for the limited inventory. In the coming months, buying activity will rise as states reopen and more consumers feel comfortable about home-buying in the midst of the social distancing measures.”

“Given the surprising resiliency of the housing market in the midst of the pandemic, the outlook for the remainder of the year has been upgraded for both home sales and prices, with home sales to decline by only 11 percent in 2020 with the median home price projected to increase by 4 percent,” Yun added. “In the prior forecast, sales were expected to fall by 15 percent and there was no increase in home price.”

While all regions reported decreases month-over-month, NAR says the rate of declines slowed in the Midwest, South and West when compared to March numbers.

Here’s the breakdown for April:

- Northeast PHSI – 42.6 (-48.2%)

- Midwest PHSI – 72.0 (-26.0%)

- South PHSI – 87.6 (-15.4%)

- West PHSI – 57.1 (-20.0%)

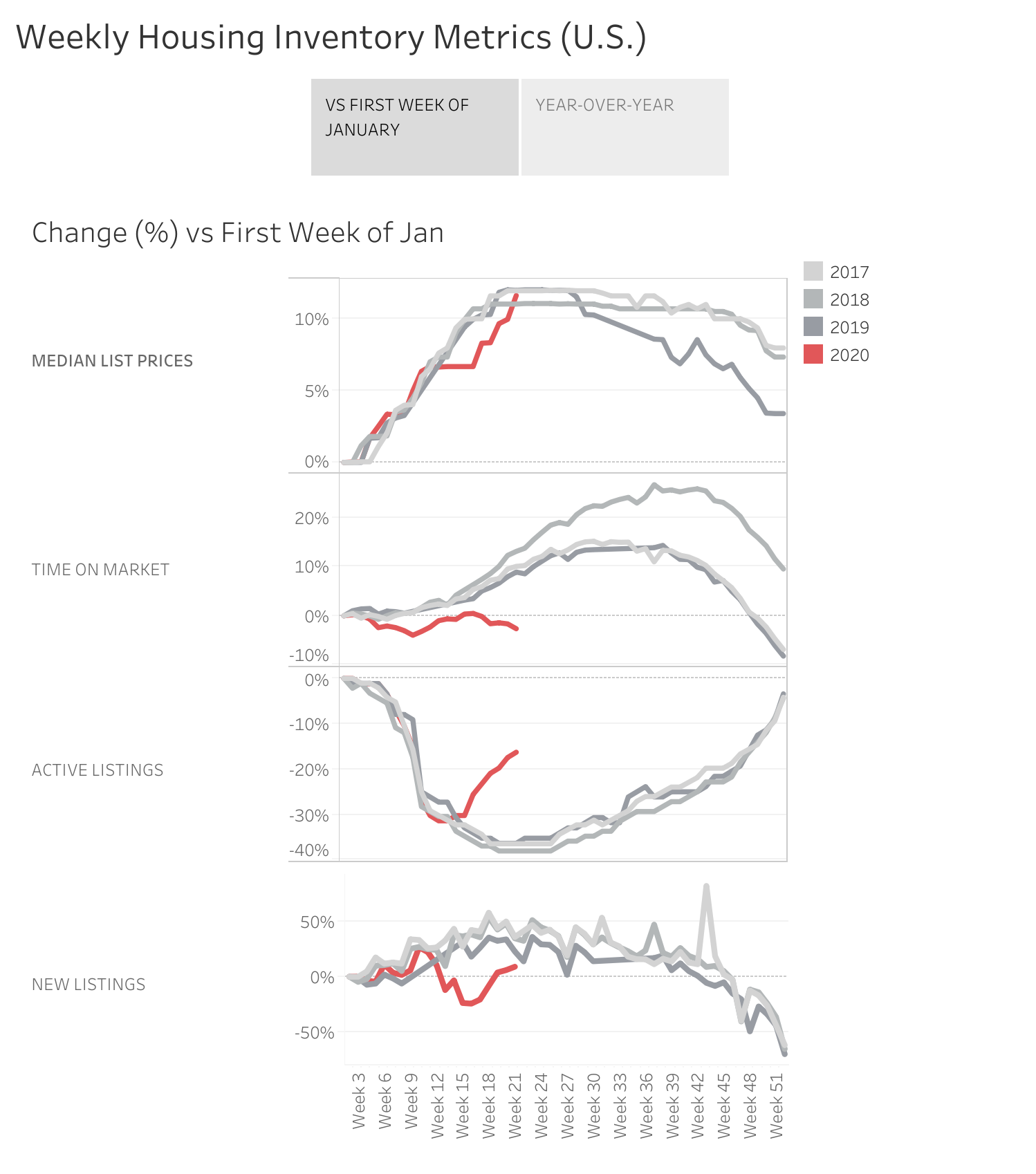

Realtor.com®’s Weekly Housing Trends Report also points to a rebound. For the week ending May 23, listings were still down, but only by 20 percent as sellers are making a return to the market. Median listings prices have regained momentum, with growth approaching pre-COVID levels, increasing 3.1 percent YoY. Due to inventory constraints, time on market is still slow, down by 16 days YoY. Realtor.com® predicts it will take a few more weeks before days on market reaches normal levels.

Source: realtor.com®

“Weekly data shows we have taken the first step in the process of returning to healthy housing conditions: getting buyers and sellers off the sidelines,” said Javier Vivas, director of economic research for realtor.com®. “The improvement in new listings this week is a sign the market is on its way to recovery, but the deficit in total inventory will be a drag on sales. Many buyers are ready and itching to get back on the market, so the faster we see sellers return, the faster home sales will recover.”

Low interest rates should continue to incentivize buyers and sellers to get back out there. Freddie Mac recently released the results of its Primary Mortgage Market Survey® (PMMS®)—the 30-year fixed-rate mortgage (FRM) now averages 3.15 percent.

Here’s the mortgage rate breakdown:

- 30-Year Fixed-Rate: 3.14 percent with an average 0.8 point for the week ending May 28 (3.24 percent last week, 3.99 percent last year)

- 15-Year Fixed-Rate: 2.62 percent with an average 0.7 point (2.70 percent last week, 3.56 percent last year)

- 5-Year Treasury-Indexed Hybrid Adjustable-Rate: 3.13 percent with an average 0.4 point (3.17 percent last week, 3.60 percent last year)

“The 30-year fixed-rate mortgage has again hit the lowest level in our survey’s nearly 50-year history, breaking the record for the third time in just the last few months,” said Sam Khater, Freddie Mac’s chief economist. “These unprecedented rates have certainly made an impact as purchase demand rebounded from a 35 percent year-over-year decline in mid-April to an 8 percent increase as of last week—a remarkable turnaround given the sharp contraction in economic activity. Additionally, refinance activity remains elevated and low mortgage rates have been accompanied by a $70,000 decline in the average loan size of refinance borrowers this year. This means a broader base of borrowers are taking advantage of the record-low rate environment, which will benefit the economy.”

As the coronavirus and its impact on the industry unfold, RISMedia is providing resources and updates. Get the latest.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to ldominguez@rismedia.com.

These figures are not all true or accurate

Thete are very strong pockects whete real estate prices have zoomed in the last few months

Especially the exodus from large cities