Despite a late summer rebound, pending home sales dipped again in September, according to the newest report from the National Association of REALTORS® (NAR).

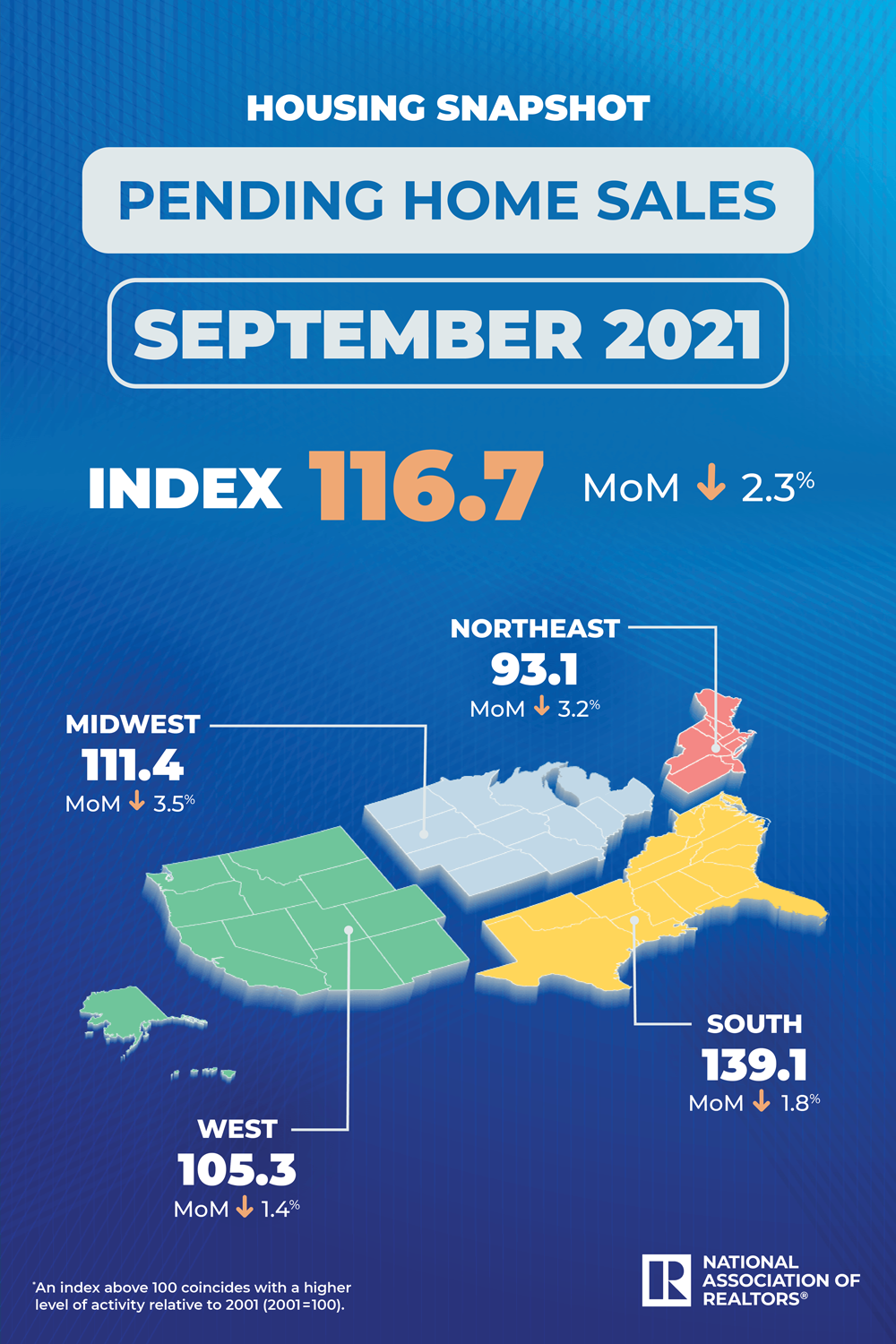

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, declined by 2.3% last month, dropping to 116.7.

All regions saw year-over-year contract signings fall last month, declining 8.0% nationally. The northeast decline was the most significant, with another double-digit drop in contract signings.

Lagging inventory was a primary factor in potential buyers momentarily pausing their home searches in September. Despite the lull in contract signings, experts predict that the buying activity will resume in 2022 as the supply of homes for sale improves.

Home sales have risen by 6.4% in 2021 based on NAR’s data from the year. Looking ahead, the association expects sales activity to decline by 1.7% in 2022 under rising mortgage rates in the new year.

Regional Breakdown:

Northeast

-3.2% MoM — Now 93.1 PHSI

-18.5% YoY

Midwest

-3.5% MoM — 111.4 PHSI

-5.8% YoY

South

-1.8% MoM — 139.1 PHSI

-5.8% YoY

West

-1.4% MoM — 105.3 PHSI

-7.2% YoY

What the Industry Is Saying:

“Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity. It’s worth noting that there will be less inventory until the end of the year compared to the summer months, which happens nearly every year.

“Rents have been mounting solidly of late, with falling rental vacancy rates. This could lead to more renters seeking homeownership in order to avoid the rising inflation, so an increase in inventory will be welcomed.”— Lawrence Yun, NAR Chief Economist

“Although home sales activity has retreated from its earlier highs, it is stabilizing at a level of activity that is above pre-pandemic pace thanks to a combination of eager young buyers, lingering pandemic savings, and low mortgage rates creating opportunity despite ongoing home price gains.\

“Whether the housing market will maintain this plateau and begin to grow again or slide back is dependent on home construction and income growth. Rising home prices will be the norm as long as demand exceeds supply, and with a 5.2 million cumulative home shortage over the last decade and many millennials entering prime home-buying age, the stage is set for that imbalance to continue. If builders continue to ramp up production, as they have, that could help stem price growth to a pace more consistent with rising incomes.

“Alternatively, as rising home prices are paired with rising mortgage rates, which have already jumped above 3%, we could see mortgage payments that require larger shares of buyer paychecks, especially if incomes grow more slowly. This could cause some buyers to opt out, dampening demand and ultimately causing sales activity and home price growth to slow.” — Danielle Hale, Chief Economist at realtor.com®

For more information, please visit www.nar.realtor

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.