2021 is going down in history as a historical year for the housing market across America. It was the year of the frustrated buyer, particularly in the first half of the year. The inventory of homes for sale and the number of homes being listed for sale were not nearly enough to satisfy the buyer demand. Multiple offers were happening on almost every property that was listed for sale. Historically when we talk about multiple offers, we are talking about maybe 2-5 offers. But not in 2021. In 2021, it was not uncommon for a property to have more than 20 offers. In fact, our REALTORS had multiple properties that had over 30 offers! Remember only one offer can win so this caused lots of disappointment for both buyers and buyer’s agents alike.

Buyers were and still are in many cases, doing anything and everything to have the winning bid. From offering dramatically over asking price, putting down massive deposits, waiving home inspection contingencies or not doing home inspections at all, waiving mortgage contingencies, agreeing to close whenever sellers want, and more.

This problem was so bad back in the late winter and spring of 2021 that many buyers gave up and signed leases to rent for another year. That is something that has happened with a large group of buyers for the last few years but in 2021 it was more than ever. The bad news for those buyers is almost all of them signed one-year leases so they will be coming out to buy in the months ahead and they are going to run into the exact same situation, except it’s going to be worse in 2022! Yes, you read that correctly, worse.

Even though the inventory of homes for sale at any given time all year stayed lower than ever, it did not decrease sales overall. Home sales were higher than previous years because homes were selling faster than they were being listed and because many private sales were happening before homes even got listed. For Massachusetts, I had predicted in my 2021 Predictions that it would be the biggest year for overall home sales since 2005 and even though the final numbers aren’t in yet, it looks like my prediction will be right on. This is explained further in the Massachusetts section below. Even though my specific prediction was for Massachusetts as far as the number of total sales, I stated in that write-up a year ago that my thinking overall was for the entire country. It will be a month before the numbers are finalized for the year, but with the number of sales as of the end of November, it looks clear I will be right.

The final year-end sale price numbers are not in but it’s already obvious that home prices rose at least 10% in all markets nationally. In South Florida, they rose over 30%. This appreciation should not really surprise anyone. With a market that has this much demand, people literally fight over homes with multiple offers, driving prices in one direction- UP!

So, what does this mean for 2022?

2022 Overall Market Predictions

My overall prediction for 2022 is more of the same as 2021, but initially worse; much worse for homebuyers, but not sellers. You could consider this better for a seller and it is, but when that seller is also buying, this extreme frenzied market makes it challenging for them as well. Here is why:

We are heading into 2022 with lower inventory than a year ago at the end of 2020. This is setting us up for the same perfect storm but this one will be worse because inventory is lower and buyer demand is just as high. It is a real problem. In my state-specific predications below, I go into more detail for Massachusetts, New Hampshire, and Florida. But my overall prediction is as follows.

For at least the first three months of 2022, there will be fewer homes for sale than in 2021 and even more offers on each home, and this highly intense multiple-offer climate will last into the summer. If you list your home for sale and don’t have multiple offers, you will know it is dramatically overpriced. Having 10+ offers on a home will be normal and agents will be arguing all over again. It will truly be a frenzy and it is going to kick off within a couple of weeks.

The problem we see every year, especially in the northern states, is most home sellers make the mistake of waiting until spring to list their homes for sale. Why? Mainly because many of them feel it’s best to wait until winter is behind us and their flowers are up outside. They could not be more wrong with this thinking, and this is why we always tell sellers to list in the winter to sell for the most money. But, only a small percentage actually listen to that. See, homebuyers don’t wait. As soon as the clock strikes midnight to the new year, buyers come out in droves and begin aggressively looking for a home. This creates a major imbalance right at the beginning of each year. This imbalance will be worse than ever in 2022 especially in the first few months and then I am hopeful (potentially wishfully thinking) that it will improve more quickly than it did in 2021.

There are two big reasons why sellers are so slow to list their homes for sale since the pandemic started:

- Many people, especially those who are older, don’t really want dozens, and sometimes over a hundred strangers coming through their home especially when the virus is everywhere like it is now. If they aren’t in a rush to sell they don’t care when a REALTOR tells them they can list and show their home in a safe manner. This improved in 2021 but now that the rates of COVID are dramatically back up, I expect this to be a problem again at least in January and February contributing to keeping inventory extremely low. I am hopeful and optimistic that this big increase in COVID in December will be gone by February. If it’s not it will certainly delay things even further.

- Home sellers are usually motivated to list when they see homes on the market that they want to buy. Home sellers are like any other consumer shopping for any other product—they do it with hesitation and a lack of trust. Many of them look around for homes in all the wrong places such as websites like Zillow. They don’t see the homes they would want to buy or they see them sell the next day and they say “well where am I going to go? I don’t want to end up homeless”. And they do nothing.

In the second example, many don’t even talk to a REALTOR which is a mistake. The ones that do often don’t hear things that will make them comfortable enough to take some steps forward, so they do nothing. This excessively low inventory situation is new to all of us; buyers, sellers, sellers who want to buy, and even REALTORS. This inventory of available homes for sale is at the lowest level since records have been kept, which is over 40 years. The fact is many REALTORS don’t know how to have these conversations with sellers who are also buying another home. They don’t know how to explain that there are ways to do this and make sure that the seller will not end up homeless.

The truth is some REALTORS out there don’t even know how to do it all. It’s not just about how to protect the client with MLS disclosures, and contingencies in the contract. It’s also about getting a client completely Ready to Strike when the right home comes up by getting their pre-approval or better yet, pre-commitment in line and their home completely and totally ready to get listed. There are many very important small details to make this happen, but some REALTORS® don’t know it all and some clients don’t listen. Sellers who want to sell and buy another home need to make sure they are hiring a REALTOR® who deals in sell/buy situations all the time. Someone who is well versed in it and has access to homes before they are listed. When you work with a REALTOR® like that, you can get this done and our REALTORS got it done for thousands of people in 2021.

Now that we have been in this extremely anemic inventory market frenzy for a while now, REALTORS® are better versed in the art of serving sell/buy clients. This experience over time gives me faith that we will come out of the slow winter faster than in 2021. I also have some hope that more sellers will list earlier than they did in 2021. Again, this could be wishful thinking.

Bottom line, my prediction for 2022 is simple. It will be much like 2021, with record-breaking amounts of home sales, more record-breaking home price appreciation, and more buyers fighting over homes. These three things are all but certain to happen in 2022. Although interest rates could change things late in the year.

Interest Rates

When the pandemic first really hit in March 2020 the Federal Reserve moved at a rapid pace to steady rates that were initially jumping up and down, but also to lower them. They reused the same playbook that they used for several years after 2008. They bought billions of dollars in Mortgage-Backed Securities to drive rates to all-time historic lows. Remember, lower mortgage rates allow for more buying power. It’s like pouring gasoline on a fire and they have been pouring on billions of gallons (dollars) a month and have continued to for a year and a half. However, now that it’s clear that the Fed at least slightly overreacted and now we are facing a real inflation problem, the Fed is going to take its foot off the gas, or I should say stop pouring gas on the fire, which will increase rates. In fact, they already have. In the first half of 2021, the average 30-year fixed-rate mortgage was 2.8% to 2.9% and now they are consistently back over 3%, and I expect rates to go up more by years’ end. I think they will go up modestly in the beginning of 2022 and then likely more by summer. As this happens, it will decrease the number of buyers, diminish buying power. This is actually a good thing for real estate overall as we cannot allow things to get out of control.

The other big change for mortgages is loan limits saw a sizable increase going into 2022. The Federal Housing Finance Agency (FHFA) announced that the baseline conforming loan limit will increase a record 18% to $647,200, which is an increase of $98,950 from $548,250 in 2021. This will make it easier for homebuyers to qualify for higher loan limits, which will certainly come in handy in this market.

Predictions by State

Massachusetts

Last year at this time when I released my 2021 Predictions I said and I quote, “we will break the 100,000 sales in a year barrier here in Massachusetts that we haven’t broke in 15 years” then I went on to say “but likely not actually beat 2005. There was so much new construction that closed that year and that is why there were so many sales.” In looking at the number of sales that we have had so far this year as of the end of November it’s clear to me that my prediction will be dead-on accurate, and we will likely land just over 100,000 sales.

As you can see in the chart below as of November 30th, we have had 91,395 sales year to date. In 2018, 2019, and 2020 we had between 82,000 and 86,000 sales by that time. So, we are at least 5,000 ahead. Notice in 2020 we had 9,920 sales in December. I doubt we will have that many this December, but we don’t need that many. All we need is 8,605 in December and I expect that we will see more than that, pushing us right over 100,000.

So what does this mean in 2022? More of exactly the same. I will go on the record right now and predict that we will see over 100,000 sales in 2022. I will also again say it will not beat 2005 which was 107,000 sales. It will be similar to 2021 which will be somewhere around 100,000 to 102,000 sales statewide.

As for prices, get ready for them to rise. In August in a video market update right at the 14-minute mark, I had predicted that in one year both interest rates and prices would be higher than they were then and I am clearly on track to be right about that. I will say the same here – both will be higher a year from now. Prices of homes will be at least 10% higher by the end of 2022. Single families will likely be 15 plus percent higher due to the continued extreme demand for them.

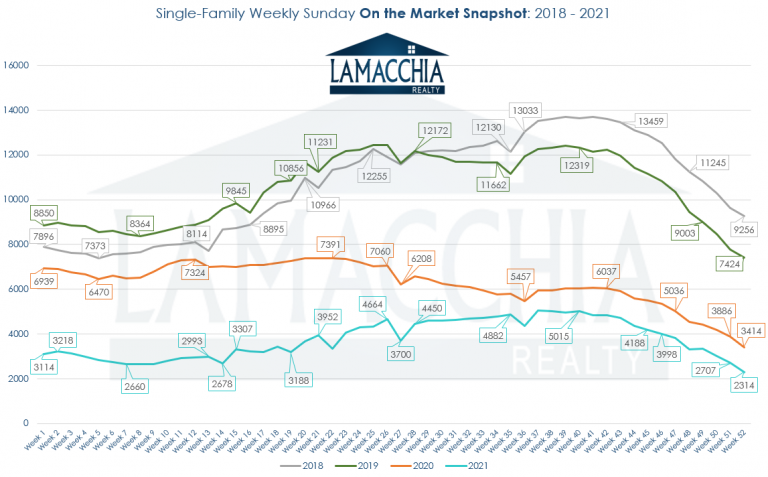

The beginning of 2022 will be especially frustrating for buyers as inventory is actually lower than it was a year ago at this time. As I discussed in my WCVB Channel 5 news interview just last week, there are currently 2,300 single families for sale compared to 3,300 a year ago which is 30% lower. But to show you truly how low it is historically listen to this; two years ago in late December of 2019 we had 7,500 single families for sale, so inventory is 69% less than it was then and that was considered low at that time! Get ready for a feeding frenzy like no one has ever seen!

The average price of a single-family home in Massachusetts year to date is $631,980. That means I expect the average after 2022 is complete to be at least $726,777. The average price of a condo is $430,329 which means I expect it to be at least $473,362 by the end of 2022.

New Hampshire

New Hampshire has been steady. It has not seen the run that Massachusetts or Florida has but it has seen increased demand since the pandemic began. That strong demand has remained, and it will continue into 2022. Over the last decade, Southern New Hampshire has really become an extension of Massachusetts with many buyers going north out of Massachusetts because they feel priced out. Then when the pandemic hit, the second home buyers went wild buying up all over the Lakes Region and up into ski country. I expect that to continue in a strong manner. In many ways, New Hampshire is New England’s playground!

The total amount of sales will be similar to 2021 and 2020 with around 24,000 but prices will follow the rest of our nation and be up at least 10%. The average price of a single-family home in New Hampshire year to date is $460,423 which means I expect the average after 2022 is complete to break the $500,000 mark. The average price of a condo is $326,390 which means I expect it to be at least $359,029 by the end of 2022.

South Florida

Florida has been one of the biggest beneficiaries of this global pandemic. It has officially turned into America’s playground and there is no end in sight. I don’t follow official travel statistics like I do housing stats, but I will say I have never seen and heard of so many friends vacationing in Florida as I have in the last year. This has greatly benefited housing as more and more people are realizing what a wonderful place it is, which is one of the reasons we opened an office there in 2020. The weather, the beaches, the restaurants, the newer infrastructure, you name it, it’s just a great place to be. The South Florida market has especially benefited from this pandemic that created a run on Florida by attracting thousands upon thousands of people from all walks of life to buy a home there. Some are second homes which South Florida has seen for years but there is also now a big influx of people just moving for good due to low taxes, the warm temperatures, and more. The low taxes are especially attractive to high-net-worth individuals, business owners, and those alike. This is what has been driving the luxury market through the roof.

What does all this mean for 2022? More of the same. Essentially a repeat of 2021 and if not then it will be even stronger with even more sales. How am I so confident? All of these additional sales and the price appreciation have happened since the start of the pandemic, even with very little international influence which is something that is typically popular all over South Florida, especially in Miami. Due to travel restrictions from countries like Canada, many would-be buyers have been boxed out. That has been slowly changing this past fall and it will continue to in months ahead. Now that the holidays are almost behind us as well, there will be an increase in these buyers coming back into the market.

For those who think that the market will crash soon, or this is another housing bubble, you are wrong. It’s not even close. I could go on all day and write a 5,000-word essay on why this is nothing like the last boom that busted, but I won’t bother. I will simply say that this boom has almost nothing in common with the last. One example is cash sales. Roughly 27% of all sales in South Florida are with cash, as in NO MORTGAGE. The percentage of sales with all cash has increased since 2020. One more reason would be the same one I have been sighting since about two weeks after the pandemic started: low inventory of homes for sale. It is not just lower than a year ago, it is nearly 50% lower which is amazing considering everyone including me said it was excessively low a year ago.

The average price of a single-family home in South Florida year to date is $844,475. I expect the average after 2022 is going to be at least $928,923 The average price of a condo is $438,142. I expect it to be at least $481,956 by the end of 2022.

Bottom line: buckle up it’s going to be another wild year ahead.

Happy New Year!

Anthony Lamacchia is the Broker/Owner of Lamacchia Realty. For more information, visit https://www.lamacchiarealty.com/.

Anthony Lamacchia is the Broker/Owner of Lamacchia Realty. For more information, visit https://www.lamacchiarealty.com/.