As we prepare to reset ahead of the new year, there are indicators that 2024 may not be the clean break from 2023 many are hoping for.

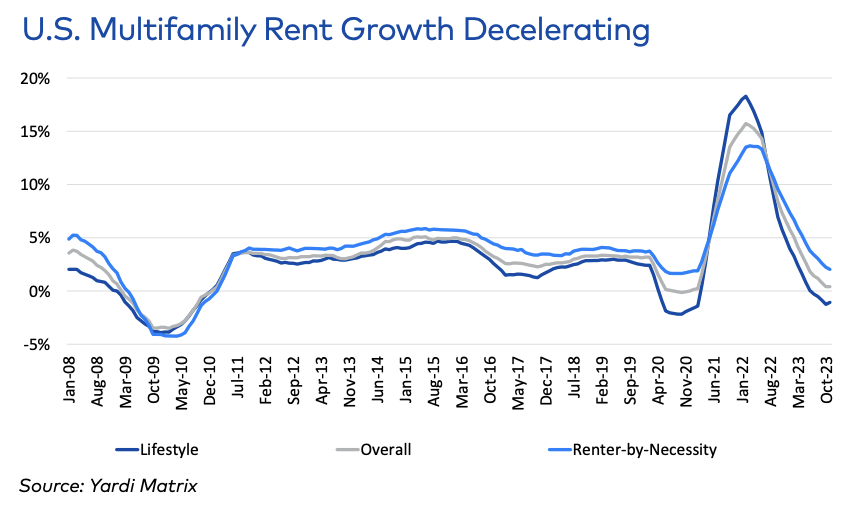

The latest Multifamily Rent Report from Yardi® Matrix found that (as of November 2023), rent growth declined 0.4% year-over-year, after a period of tremendous growth in 2021-2022 (a combined 23.5%). The report projects that rent prices will continue to slow in 2024.

Supply is a big factor in play here; 1.2 million apartment units will be under construction when 2024 begins and about half of those (510,000) will be completed by the year’s end. This is “the highest number (of new units) in decades,” which will drive down prices. The report highlights stalling rent growth in booming Southern and Sunbelt markets such as Austin and Nashville as a sign of supply stalling rent hikes.

The Midwest, meanwhile, is projected to be the regional leader in rent growth – the metro areas with the highest projected rent growth in 2024 are Kansas City, Missouri (2%), Columbus (1.9%), and Indianapolis (1.8%).

The report suggests the economy is in an overall place of cautious uncertainty going into 2024, between a loosening labor market, unclear pricing projections, and the Federal Reserve’s hawkishness on interest rates. As a result, investment in multifamily unit sales was down by 70% year over year.

As quoted in the report, analysts say:

“We expect demand for multifamily to remain healthy in 2024, but headwinds that include slower job growth, increasing supply and waning affordability in some markets will keep rent growth restrained again.”

The full report can be read here.