Above, NAR CEO Nykia Wright, left, with NAR President Kevin Sears.

The National Association of REALTORS® (NAR) has long been the face of organized real estate, even for non-members and critics—who have grown in number in recent years, as the organization suffered a generational court loss among numerous other missteps.

But a year and a half after the Burnett verdict, NAR and its turnaround CEO Nykia Wright appear to be winning back members’ trust, as RISMedia’s latest Broker Confidence Index (BCI) finds Wright and her team with a (very slight) positive approval rating, and NAR itself earning positive marks on some core functions.

“I believe the new CEO is doing all the right things. She clearly has a vision for the future and is communicating that vision clearly to us in the field,” said David Nichols, broker/owner of RE/MAX Elite in Missouri.

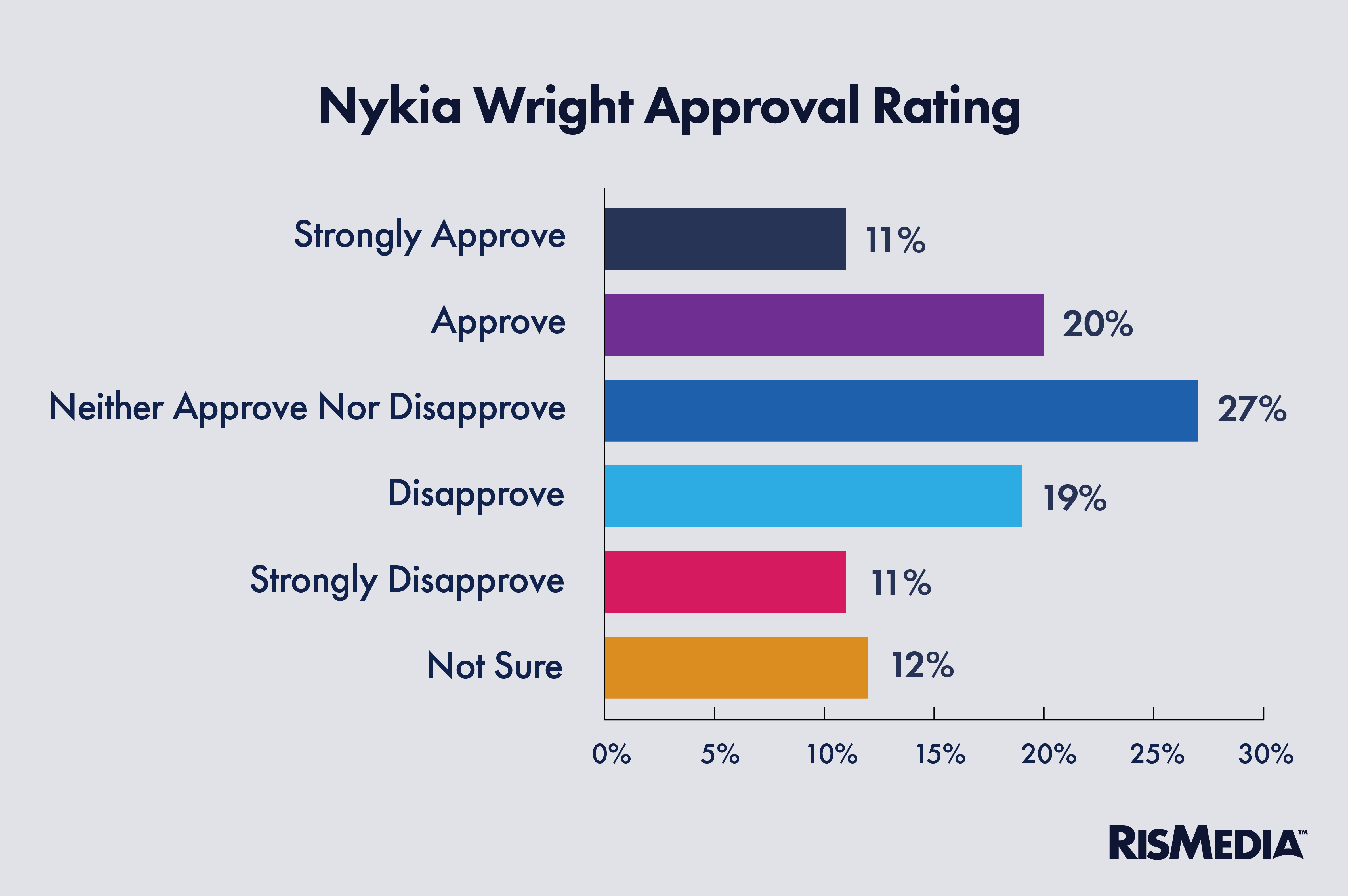

RISMedia asked brokers to rate Wright’s job performance, coinciding with NAR’s midyear Legislative Meetings, where the new leadership group promised to refresh the organization’s functions and mission.

Those who approved and those who disapproved of Wright and her team were almost exactly split, with 31% of brokers saying they approved, and 30% saying they disapproved.

Notably, a plurality of brokers are on the fence, with 39% saying they are not sure, or neither approve nor disapprove of Wright and her team, leaving a significant number of people who are seemingly open to NAR’s turnaround attempt.

Notably, a plurality of brokers are on the fence, with 39% saying they are not sure, or neither approve nor disapprove of Wright and her team, leaving a significant number of people who are seemingly open to NAR’s turnaround attempt.

“We’ll see what comes (out) of midyear, but so far not real impressed,” said one broker, who requested anonymity.

Though far from a mandate, the sentiment represents a major shift in tone from even a year ago when an upstart group sought to create an alternative real estate association, and backlash to the class-action settlement agreement (which notably excluded almost 100 companies) roiled the industry.

At the Legislative Meetings earlier this month, NAR President Kevin Sears essentially apologized to big brokers for the fact they were excluded from the settlement agreement, admitting that NAR needs to win back their trust in what represented a significant shift in tone from leadership.

Harold Crye, owner of independent brokerage Crye-Leike based in Tennessee (which was excluded from the settlement) wrote in the BCI survey that NAR needed to help brokers “who got the shaft on lawsuits” if it wanted to show new leadership was shifting tack.

Although Wright took the helm at NAR on an interim basis back in 2023, she was named the permanent CEO less than a year ago, in August of 2024. She has promised an extensive legal review of NAR policies, and made member outreach a priority of her tenure so far.

At the midyear meetings, Wright also promised to make NAR a “basecamp” for members, outlining a more holistic approach to service that will include support for core business functions and concerns.

Qualitatively, there were many BCI respondents who expressed continued frustration with NAR, and doubted that Wright and her team would be able to steady the ship. Brokers were asked what specific evidence they were hoping to see that could prove NAR was actually making real change.

“I don’t know if they can change my mind,” said Frank Gay, co-founder and CEO of Home Pros Real Estate Group in Texas. “I don’t know anyone that advocates for them anymore except those that buy in and are in leadership, or on the board of directors.”

Other brokers offered a variety of suggested actions or scenarios, with many urging Wright to shrink the Board of Directors, increase consumer outreach or marketing efforts or cut costs. More than one in 10 (11%) brokers said they wanted NAR to abandon the three-way agreement or make membership “optional,” while a similar proportion (10%) mentioned shifting course on legal issues.

“NAR needs to focus on high-level political change that focuses on the DOJ issues and the settlement that was not good for brokers, agents or consumers,” said Richard McKinney, broker/owner of RE/MAX Gold in Florida.

Function and policy

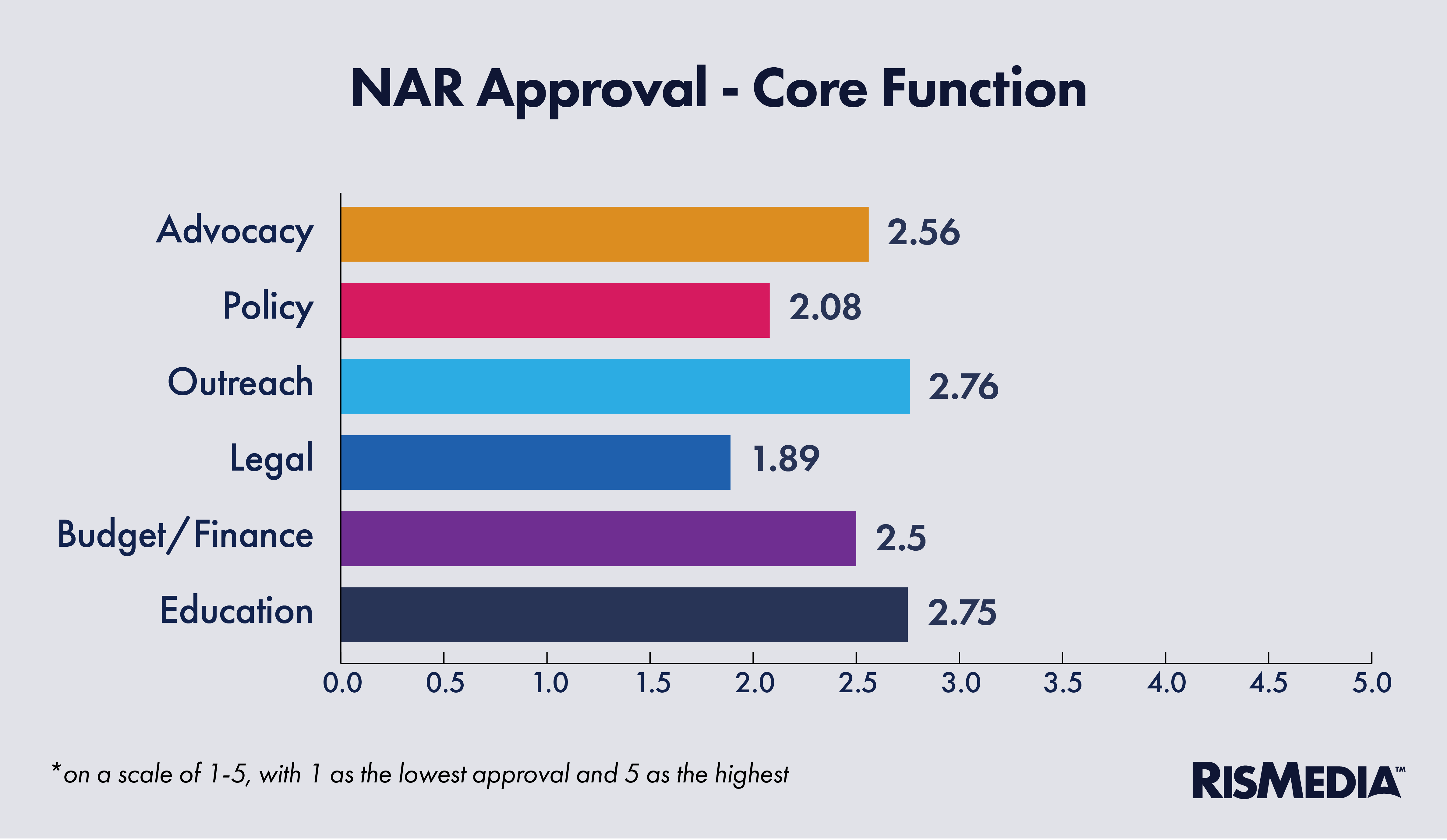

Asked to rate NAR’s performance on specific issues over the last six months or so, brokers remained highly critical of legal strategy or moves, with over half giving the organization the lowest possible rating. Respondents also largely disapproved of recent policy decisions, which include standing by Clear Cooperation (with some new exceptions) and removing anti-hate speech language from the Code of Ethics.

But ratings on budget, advocacy, education and outreach all tipped positive on average, with brokers seeming cautiously optimistic that NAR is starting to engage with members to shift its approach to these functions.

But ratings on budget, advocacy, education and outreach all tipped positive on average, with brokers seeming cautiously optimistic that NAR is starting to engage with members to shift its approach to these functions.

“(NAR) appears to be focused on listening and taking action based on member sentiment. The next 12 months will be a telltale for what we can expect from our industry association,” said one broker, who requested anonymity.

Market sentiment

Looking at real estate as a whole right now, overall broker confidence rose slightly, from 6.1 to 6.3—still the lowest spring reading in the BCI’s history, as tariffs and economic uncertainty have weighed on market activity.

Most brokers pointed to this uncertainty, along with so-far unassailable affordability issues, as most affecting their confidence. Crye said many buyers are still waiting for lower rates., while other brokers described a relatively brisk market, with demand growing despite the headwinds.

Most brokers pointed to this uncertainty, along with so-far unassailable affordability issues, as most affecting their confidence. Crye said many buyers are still waiting for lower rates., while other brokers described a relatively brisk market, with demand growing despite the headwinds.

“We are still seeing houses sell in short periods of time and list price to sales price ratios that are strong,” said one Massachusetts-based broker who requested anonymity.

But the macroeconomic picture appears to be an obstacle even as the Trump administration has paused tariffs and even struck a few trade deals. While other recent surveys found consumer outlook growing sunnier, brokers reported that prospective buyers remain wary in the current climate.

“Broader economic uncertainty, affordability and fear of recession are primary drivers impacting buyer sentiment,” said another anonymous broker.