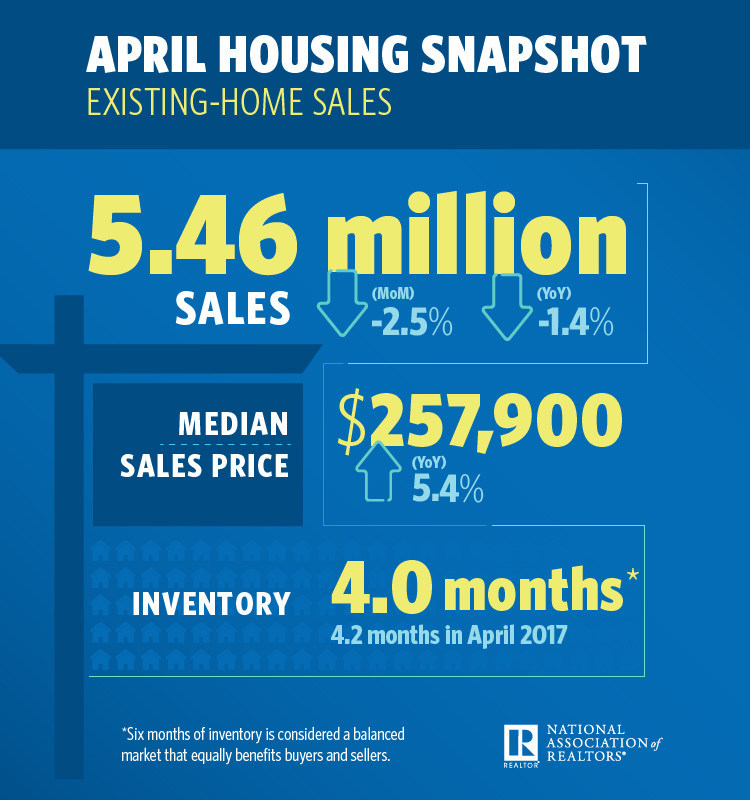

After early gains in the season, April existing-home sales fizzled, with every region sputtering, the National Association of REALTORS® (NAR) reports. Activity in April declined 2.5 percent to 5.46 million, down 1.4 percent from the prior year. Inventory increased 9.8 percent to 1.8 million, but, by comparison, was 6.3 percent lower than the prior year.

“The root cause of the underperforming sales activity in much of the country so far this year continues to be the utter lack of available listings on the market to meet the strong demand for buying a home,” says Lawrence Yun, chief economist at NAR. “REALTORS® say the healthy economy and job market are keeping buyers in the market for now, even as they face rising mortgage rates; however, inventory shortages are even worse than in recent years, and home prices keep climbing above what many home shoppers are able to afford.”

Currently, inventory is at a four-month supply. In April, existing homes averaged 26 days on market, three days less than the prior year. All told, 57 percent of homes sold were on the market for less than one month.

“What is available for sale is going under contract at a rapid pace,” Yun says. “Since NAR began tracking this data in May 2011, the median days a listing was on the market was at an all-time low in April, and the share of homes sold in less than a month was at an all-time high.”

In April, the metropolitan areas with the fewest days on market and most realtor.com® views, according to realtor.com®’s Market Hotness Index, were Midland, Texas; Boston-Cambridge-Newton, Mass.; San Francisco-Oakland-Hayward, Calif.; Columbus, Ohio; and Vallejo-Fairfield, Calif.

The median existing-home price for all house types (single-family, condo, co-op and townhome) was $257,900, a 5.3 percent increase from the prior year. The median price of an existing single-family home was $259,900, while the median price for an existing condo was $242,500.

“With mortgage rates and home prices continuing to climb, an increase in housing supply is absolutely crucial to keeping affordability conditions from further deterioration,” says Yun. “The current pace of price appreciation far above incomes is not sustainable in the long run.”

Existing-home sales in the single-family space came in at 4.84 million in April, a 3 percent decrease from 4.99 million in March, and a 1.6 percent decrease from 4.92 million the prior year. Existing-condo and -co-op sales came in at 620,000, a 1.6 percent increase from March, and no different than the prior year.

Twenty-one percent of existing-home sales in April were all-cash, with 15 percent by institutional investors; 3.5 percent were distressed.

Across the country, existing-home sales fell or remained stagnant, declining 4.4 percent in the Northeast to 650,000, with a median price of $275,200; declining 3.3 percent in the West to 1.19 million, with a median price of $382,100; declining 2.9 percent in the South to 2.33 million, with a median price of $227,600; and unchanged in the Midwest, at 1.29 million, with a median price of $202,100.

Additionally, first-time homebuyers comprised 33 percent of existing-home sales in April, up from 30 percent in March.

“Especially with mortgage rates going up in recent weeks, prospective buyers should visit with more than one lender to ensure they are getting the lowest rate possible,” says NAR President Elizabeth Mendenhall. “Receiving a rate quote from multiple lenders could lead to considerable savings over the life of the loan. Ask a REALTOR® for a few recommendations of lenders to contact to get a quote.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.