For the housing market, gaining ground is proving to be a struggle.

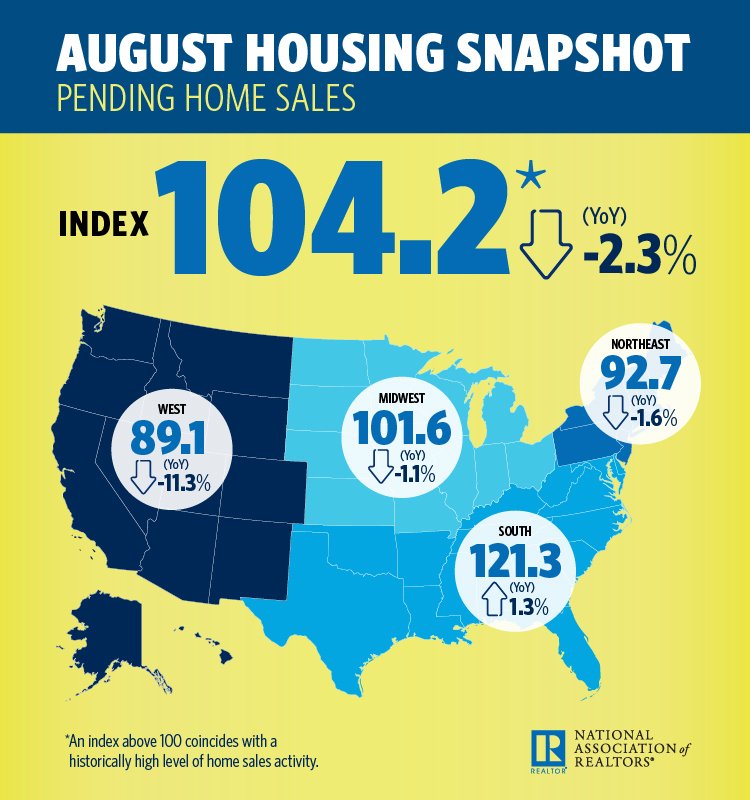

On an annual basis—and for the eighth month in a row—pending home sales slipped, according to the August National Association of REALTORS® (NAR) Pending Home Sales Index (PHSI). Activity backtracked 1.8 percent month-over-month and 2.3 percent year-over-year.

According to the Index, activity contracted in all of the regions in the U.S. In the Midwest, activity declined 0.5 percent from July, and 1.1 percent from the prior year; in the Northeast, activity decreased 1.3 percent from July, and 1.6 percent from the prior year; in the South, activity dipped 0.7 percent from July, but rose 1.3 percent from the prior year; and in the West, activity fell 5.8 percent from July, and 11.3 percent from the prior year.

“Pending home sales continued a slow drip downward, with the fourth month-over-month decline in the past five months,” says Lawrence Yun, chief economist at NAR. “Contract signings also fell backward again last month, as declines in the West negatively impacted overall activity. The greatest decline occurred in the West region, where prices have shot up significantly, which clearly indicates that affordability is hindering buyers—and those affordability issues come from lack of inventory, particularly in moderate price points.”

The good news? Yun anticipates relief—but at what point is uncertain.

“With prices having risen so quickly, many consumers were deciding to wait to list their homes hoping to see additional price and equity gains; however, with indications that buyers are beginning to pull out, price gains are going to decelerate and potential sellers are considering that now is a good time to list and bring more properties to the market,” Yun says.

Additionally, while affordability is being constrained by increasing rates, advancements on the employment front could offset the pressure.

“We have two opposing factors affecting the market: the negative impact of rising mortgage rates and the positive impact of continued job creation,” says Yun. “This should lead to future homes sales staying fairly neutral. As long as there is job growth, rising mortgage rates will hinder some buyers—but job creation means second or third incomes being added to households, which gives consumers the financial confidence to go out and make a home purchase.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.