Appreciation is continuing to level off, marking a return to steadier times.

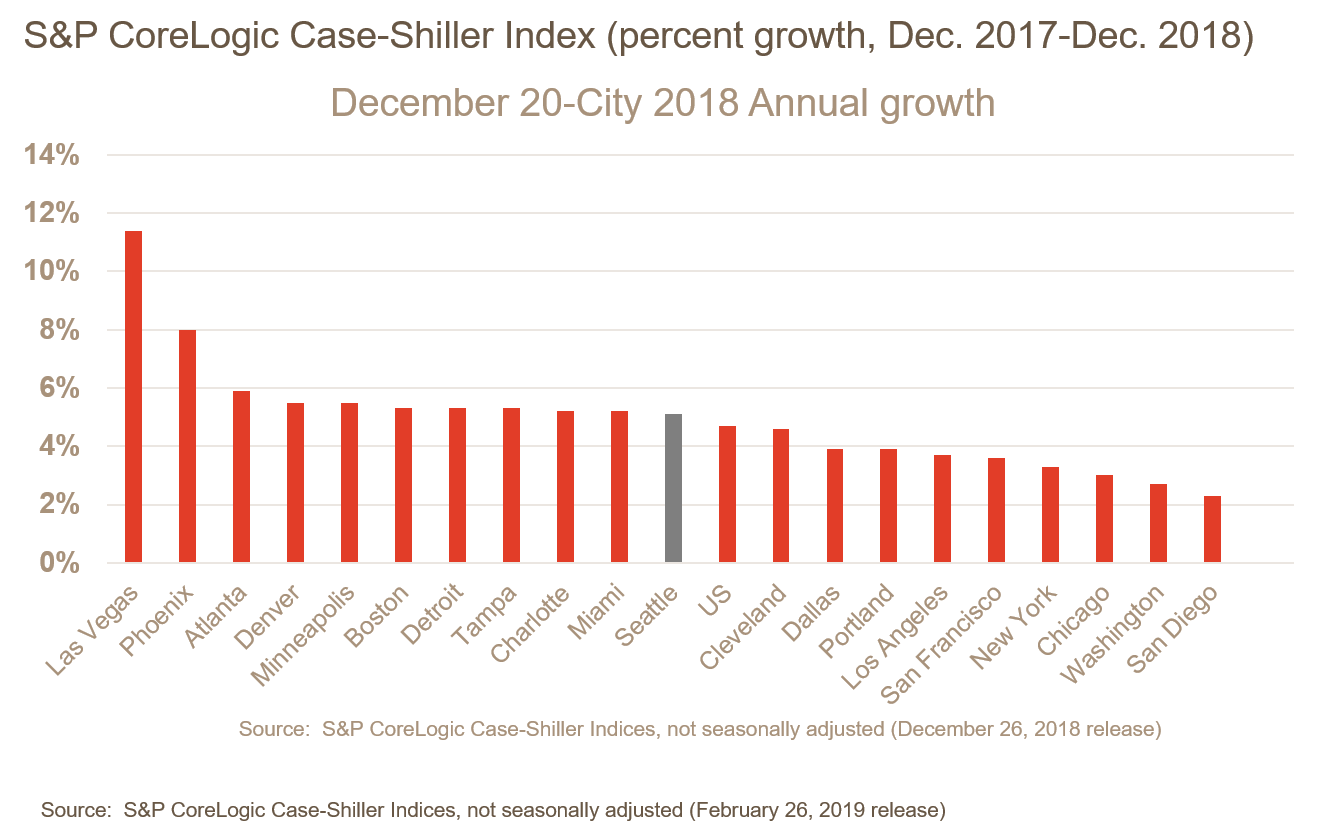

In December, home prices rose 4.7 percent, according to the S&P CoreLogic/Case-Shiller Indices, newly released this week. In November, home prices were up 5.1 percent.

“2018 was a turning point for home price growth in the U.S. housing market,” says Ralph McLaughlin, deputy chief economist and executive of Research and Insights at CoreLogic. “In 2018, we saw monthly over-the-year gains in home prices grow at the slowest rate for a calendar year since 2014.”

Despite the pull-back, appreciation is blowing by earnings growth and inflation, says David M. Blitzer, chairman and managing director of the Index Committee at S&P Dow Jones Indices—a problem for sales.

“Even at the reduced pace of 4.7 percent per year, home prices continue to outpace wage gains of 3.5 percent to 4 percent and inflation of about 2 percent,” Blitzer says. “A decline in interest rates in the fourth quarter was not enough to offset the impact of rising prices on home sales. The monthly number of existing single-family homes sold dropped throughout 2018, reaching an annual rate of 4.45 million in December. The 2018 full-year sales pace was 4.74 million.”

“With inventory now rising from historic lows and price gains continuing to outpace wage growth, we should see home price appreciation settle toward more reasonable levels throughout 2019 and the remainder of this economic cycle,” McLaughlin says.

The complete data for the 20 markets measured by S&P:

Atlanta, Ga.

MoM: 0.1%

YoY: 5.9%

Boston, Mass.

MoM: -0.5%

YoY: 5.3%

Charlotte, N.C.

MoM: 0%

YoY: 5.2%

Chicago, Ill.

MoM: -0.7%

YoY: 3%

Cleveland, Ohio

MoM: -0.4%

YoY: 4.6%

Dallas, Texas

MoM: 0%

YoY: 3.9%

Denver, Colo.

MoM: -0.1%

YoY: 5.5%

Detroit, Mich.

MoM: -0.4%

YoY: 5.3%

Las Vegas, Nev.

MoM: 0.2%

YoY: 11.4%

Los Angeles, Calif.

MoM: 0%

YoY: 3.7%

Miami, Fla.

MoM: 0.1%

YoY: 5.2%

Minneapolis, Minn.

MoM: -0.5%

YoY: 5.5%

New York, N.Y.

MoM: 0.2%

YoY: 3.3%

Phoenix, Ariz.

MoM: 0.1%

YoY: 8%

Portland, Ore.

MoM: -0.3%

YoY: 3.9%

San Diego, Calif.

MoM: -0.7%

YoY: 2.3%

San Francisco, Calif.

MoM: -1.4%

YoY: 3.6%

Seattle, Wash.

MoM: -0.6%

YoY: 5.1%

Tampa, Fla.

MoM: -0.1%

YoY: 5.3%

Washington, D.C.

MoM: -0.2%

YoY: 2.7%

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.