In 2018, 1.2 million households materialized. In the same time, builders completed 1.18 million units, and initiated 1.2 million starts.

Close-but-not-quite-enough construction is the determining factor for the future of housing, according to Harvard University’s 2019 State of the Nation’s Housing, released this week. According to the report, experts are forecasting 8 million more homeowners by 2028—a figure that has the potential to reach 10.1 million, if gains in the homeownership rate stabilize.

Baby boomers are expected to fuel the increase, adding 11.1 million households, both homeowner and renter, in addition to millennials, who are anticipated to drive 2.9 million formations in the next 10 years, the report shows.

While the growth in households is normalizing, accommodating the boom is dependent on inventory, which has barely kept pace today. For more than 40 years, construction has exceeded the growth in households by 30 percent, according to the report; in 2018, the deficit was estimated at 260,000.

Further, of the 50 largest markets in the nation, eight had households outpace permits, including San Francisco, where there was a significant squeeze: 79 approvals were issued for every 100 households minted. There were imbalances in Boston; Columbus, Ohio; Denver; Phoenix; Sacramento; San Antonio; and San Diego, as well.

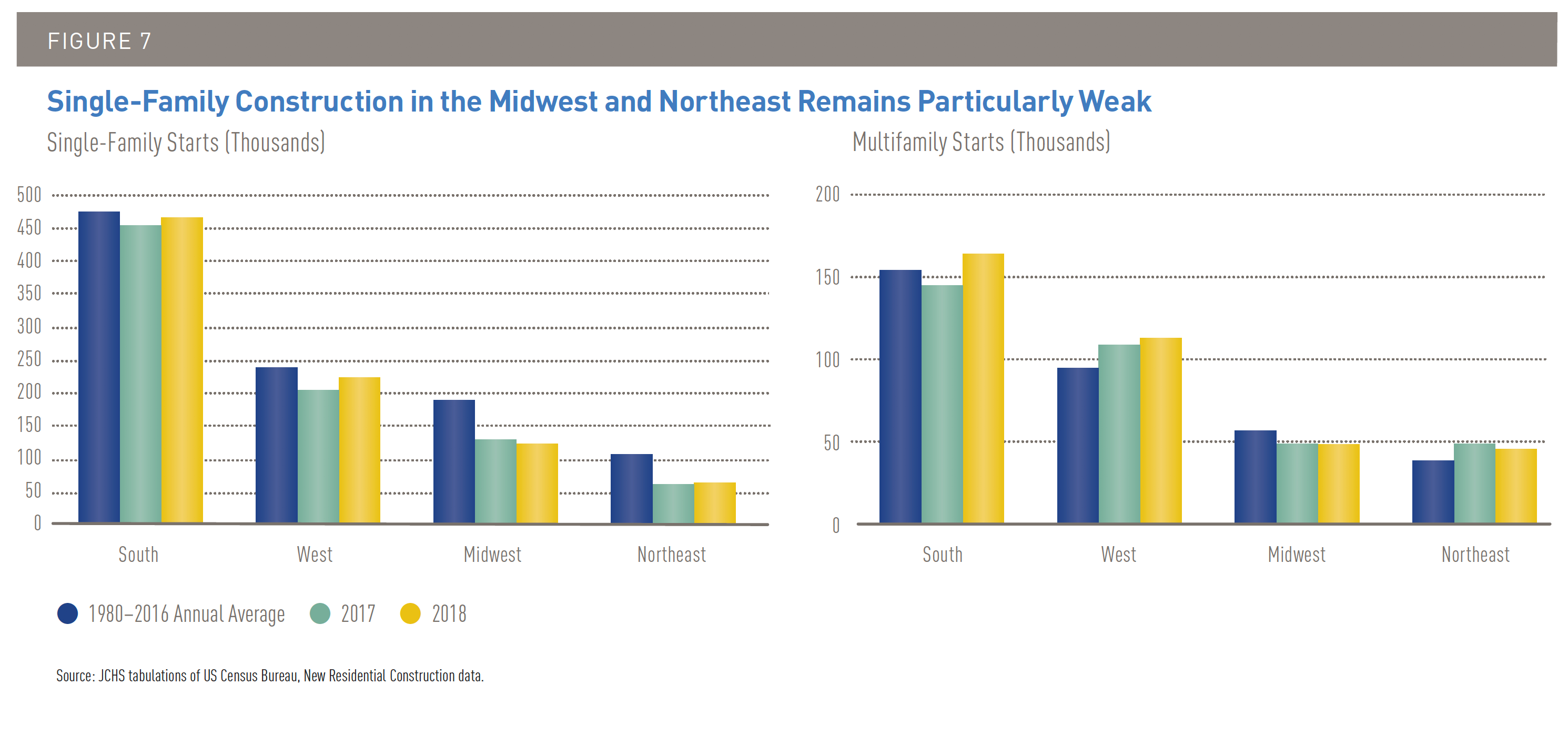

The gap is marked in the single-family space, which in 2018 added less than 1 million starts—continuing an 11-year trend, the report shows. On paper, there were increases regionally, but compared to the 1980-2016 period, construction is down 13 percent nationally, by as much as 35 percent in the Midwest and 40 percent in the Northeast.

Harvard Joint Center for Housing Studies, The State of the Nation’s Housing 2019, All Rights Reserved, www.jchs.harvard.edu

Of the builds that are making it to market, the majority are priced in upper tiers. In 2018, 22 percent of completions in the single-family space were less than 1,800 square feet in size, according to the report—ideal for millennials and new owners. From 1999-2011, the average was 32 percent.

Builders are challenged to create homes with more practical price tags, chiefly due to increases in land prices and regulation. Looking at the median nationwide, land prices are up 27 percent, climbing from $159,800 per acre in 2012 to $203,200 per acre in 2017, according to the report. With costs escalating, the margins are slim in the starter tier, and builders are focusing on more profitable projects.

An additional challenge is the pool of workers, which has been dwindling in recent years. In 2018, there were 275,000 construction job openings—an increase of 39 percent year-over-year, according to the report.

There is an air of caution, as well, among builders and developers. In the early 2000s, construction soared, with an ensuing glut of homes as a result.

With the discrepancy in the housing stock, affordability is a critical issue. According to the report, the earnings-to-home price ratio is widening, growing from 3.3 in 2011 to 4.1 in 2018. In 2012, the median monthly mortgage payment was $1,176, down 45 percent from 2006, when it peaked, and 36 percent from 1990. By 2018, it ballooned to $1,775, 17 percent below the 2006 cost, and 3 percent below the 1990 level.

Harvard Joint Center for Housing Studies, The State of the Nation’s Housing 2019, All Rights Reserved, www.jchs.harvard.edu

Harvard Joint Center for Housing Studies, The State of the Nation’s Housing 2019, All Rights Reserved, www.jchs.harvard.edu

For a buyer to front 3.5 percent for a median-priced purchase in 2018, they had to have saved $9,000, the report shows—and for a 20 percent down payment, $52,000. While incomes have tracked up, they are being exceeded by existing for-sale home prices.

Affordability is also linked to mortgage rates, which are at historic lows today, but could take a turn. According to the report, a 1 percentage point hike in interest on a median-priced purchase in 2018 increased the monthly payment by $153.

Encouragingly, there have been inroads. From 2010-2017, the amount of households in the 30 percent-plus range—that is, paying more than 30 percent of their pay for their property or rental—shrank, down to 31.5 percent of households, the report shows. On the homeowner side, 22.5 percent are in this range, also a decline.

Barring builders overcoming pressures, demand is expected to increase in the next 10 years, with baby boomers and millennials moving the needle, the report summarizes.

“To ensure that the market can produce homes that meet the diverse needs of the growing U.S. population, the public, private and nonprofit sectors must address constraints on the development process,” says Chris Herbert, managing director of Harvard’s Joint Center for Housing Studies, which published the report.

“For the millions of families and individuals who struggle to find housing that fits their budget, public efforts will be necessary to close the gap between what they can afford and the cost of producing decent housing,” Herbert says.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.