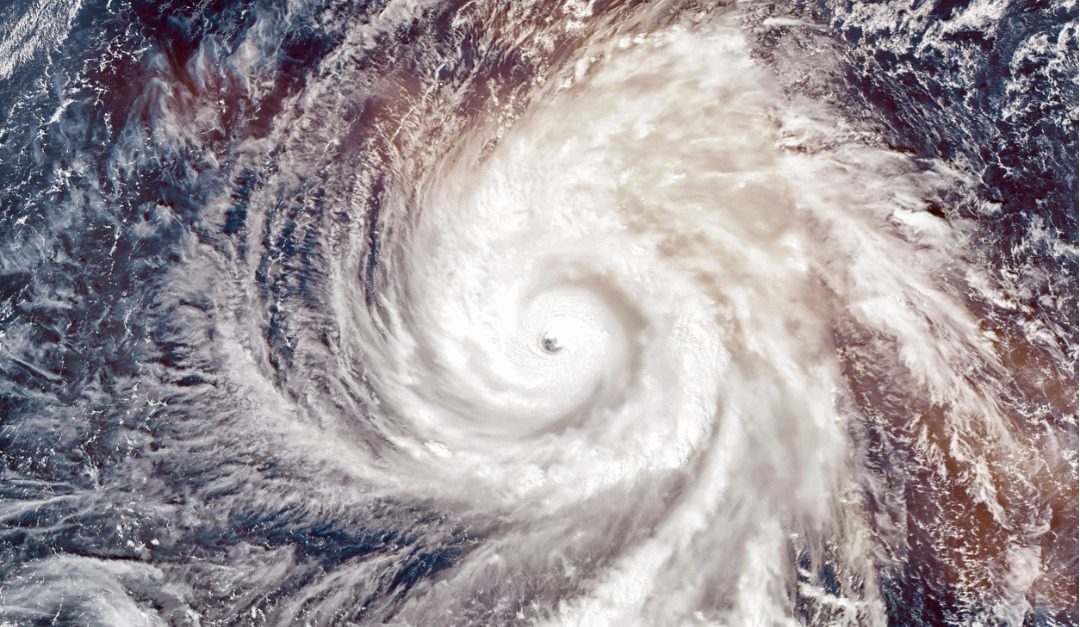

Hurricane Ida made landfall in Louisiana on Sun., Aug. 29 as a Category 4 hurricane, with the first death reported in Prairieville due to injuries sustained from a fallen tree. Now weakened to a tropical storm as it heads to Mississippi [at press time], the natural disaster has left a little more than 1 million homes without power after dumping a dangerous mix of torrential rains and high-speed winds that ripped off roofs and caused extensive flooding, according to local utility companies.

The National Hurricane Center said that the rain and storm surge “resulted in catastrophic impacts along the Southeast coast of Louisiana.”

According to a report from CoreLogic released last week, 941,392 homes were at risk from Hurricane Ida storm surge, with a combined reconstruction cost value (RCV) of about $220.37 billion.

“Atmospheric conditions are highly favorable for rapid intensification after Ida emerges from Cuba on Saturday into Sunday,” said Dr. Daniel Betten, meteorologist and senior leader for Weather Science at CoreLogic, in a statement last week. “Ida will also be passing over an extremely warm loop current, which is known to contribute to the rapid intensification of hurricanes in the central Gulf of Mexico, most famously seen with Hurricanes Katrina and Rita in 2005.”

President Biden approved a major disaster declaration for Louisiana. Those impacted by the hurricane can now visit the Federal Emergency Management Agency (FEMA) to apply for assistance.

In terms of reporting damage post-hurricane to insurance providers, the Louisiana Department of Insurance suggest the following steps, according to WDSU:

- Contact your agent or insurance company

- Keep all receipts for minor repairs made

- Take video and photos of the damage and the home’s contents

- Keep any damaged items for the claims adjuster so you may recover lost funds

Freddie Mac is providing resources for those impacted by the hurricane, reminding homeowners that safety, not payments, are priority.

“Along with our mortgage servicers, Freddie Mac stands ready to provide immediate mortgage relief options to those affected by Hurricane Ida,” said Bill Maguire, Freddie Mac’s vice president of Single-Family Servicing Portfolio Management.

“Once safe, homeowners whose homes are impacted should contact their mortgage servicer—the company they send their monthly mortgage payments to—as soon as possible to talk about available mortgage relief options,” added Maguire. “This also includes homeowners whose places of employment have been impacted resulting in a financial hardship that prevents them from being able to make their monthly payment.”

Freddie Mac has several short-term forbearance options available, providing relief from mortgage payments for up to 12 months. When ready to make up missed payments, homeowners can:

- Reinstate their mortgage, paying a lump sum payment to get back on track quickly

- Getting on a repayment plan, paying more each month on top of their existing mortgage payment to make up the missed payments

- Getting on a deferral plan, with missed payments added to the end of the mortgage term without interest or penalties

- Having their loan modified if a reduced mortgage payment is needed

For brokers and agents in need of aid, the REALTORS® Relief Foundation raises funds for victims of disasters, including wildfires, tornadoes, floods and hurricanes.

To continue assisting clients in navigating natural disasters, real estate practitioners can visit their local REALTOR® association for resources and education. Louisiana REALTORS®, for example, provides an ongoing Flood Risk & Recovery series, in collaboration with FEMA the Louisiana Department of Transportation & Development, that offers information regarding flood insurance, disaster preparation and recovery.

This is a developing story. Stay tuned to RISMedia for updates.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to lizd@rismedia.com.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to lizd@rismedia.com.