Clear Cooperation, the MLS policy that requires listings be posted to the MLS (with some key exceptions), is dividing the industry.

That is not an anecdotal or offhand assessment. RISMedia’s latest Broker Confidence Index (BCI) survey, carried out as brand leaders spar publicly over the rule (and with a Department of Justice (DOJ) investigation and an antitrust lawsuit looming), found that the broker community is split on the path forward—though a majority still wants some form of Clear Cooperation to exist.

As the National Association of REALTORS® (NAR) considers potential changes to the policy—promising to solicit feedback from members before any final decision—the survey of brokers shows that the choice might not be as simple as repealing or not repealing Clear Cooperation.

As the National Association of REALTORS® (NAR) considers potential changes to the policy—promising to solicit feedback from members before any final decision—the survey of brokers shows that the choice might not be as simple as repealing or not repealing Clear Cooperation.

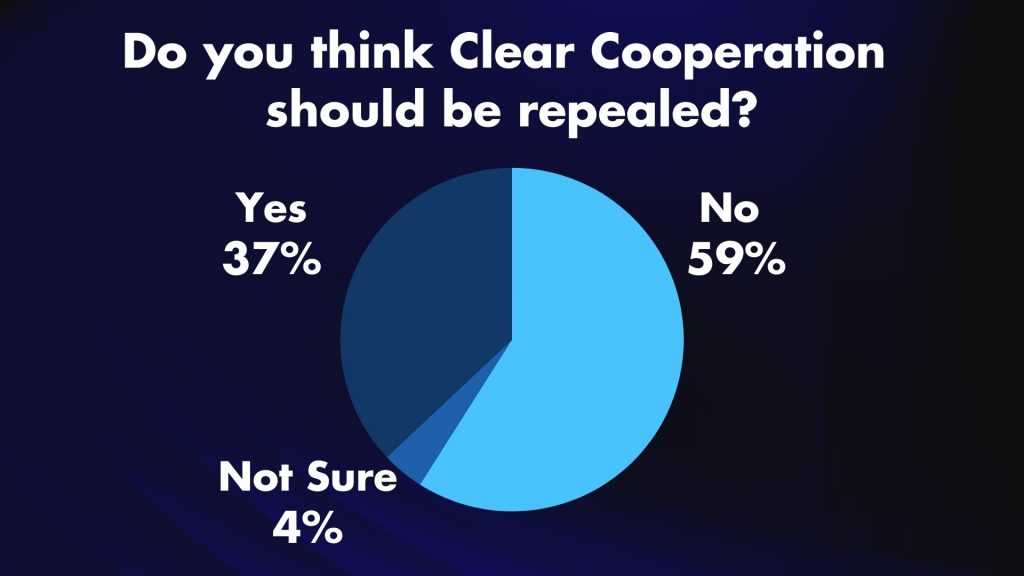

At the highest level, 59% of brokers opposed an repeal, while 37% supported ending the nationally mandated policy. Among the brokers who didn’t want the policy repealed, 38% said they still wanted NAR to modify the rule. Overall, 37% of respondents said they opposed any modification or repeal of Clear Cooperation.

Brokers who wanted a repeal were also far from united around one course of action. Just over one-fifth (21%) of brokers who expressed support of repeal were still open to a situation where individual MLSs could adopt the policy independently, for their own members.

Supported by additional qualitative responses, the BCI survey shows that brokers understand the difficult balance between the stated purpose of Clear Cooperation (data integrity, consumer access to listings and fair housing) with the risks and criticisms, but are also split on what they believe should be the future priorities of the MLS.

Almost one-in-five (19%) respondents said MLSs should be focused on avoiding legal issues, or lobbying governments to protect real estate interests, clearly demonstrating a level of frustration with the current legal environment. Close to four-in-10 (39%) said they wanted tech improvements or investment, more in line with general understanding of the role of MLSs.

But even more brokers (44%) said they wanted to see bigger changes, including buyer-only brokerages, consumer-facing portals, consolidated state-wide data access and physical shared spaces for members, among other things. This would appear to indicate that brokers are looking for the MLS industry to evolve more dramatically as the industry at large navigates historic shifts, from lawsuits to competition from portals.

“Fear stemming from all the lawsuits is the No. 1 (factor),” said one broker, who requested anonymity.

Hail to the chief

With just over one month until the presidential election, and at the beginning of what is usually a slower period for real estate, the other headline coming out of this month’s BCI survey is that brokers are actually feeling significantly more positive about the market in general.

The trend constitutes a significant reversal from previous years, with RISMedia’s BCI also rising last month. The index is now 1.4 points higher than at the same point last year, when rising rates and still-rampant inflation depressed home sales to their lowest level in almost three decades.

And while the uncertainty of a close and bitter presidential election season might be projected to weigh on broker’s confidence levels, that did not seem to be the case, with brokers who mentioned political upheaval as a worry still expressing high levels of confidence in the market.

In fact, brokers who mentioned the election had a higher overall confidence level in real estate at 7.9.

But for the most part, brokers cited industry-specific factors—falling rates, rising inventory and eager buyers and sellers—as the biggest element in boosting their confidence this month. At the same time, several also said they have yet to see the predicted influx of buyers materialize in their regions, even as rates approach 6%.

“Buyers are still sitting on the fence waiting to see where interest rates will bottom out,” said Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas.

“My local market is starting to see ‘days on market’ go up for the first time in 2.5 years,” said one broker, who requested anonymity.

With rates likely to fall even further as the Federal Reserve expresses growing confidence that the economy is on the right track, the possibility of a full turnaround and more significant housing rebound heading into 2025 appears very real. At the same time, though, housing economists made similar predictions for 2024, and a market rally has so far failed to materialize.